The dollar’s stabilization through most of this month was clearly not enough to dent prolonged bearish sentiment among a key investor group, which risks deepening as the prospect of a US government shutdown weighs on sentiment.

Speculative traders added to their already-short positioning on the US currency in the week through Sept. 23. Non-commercial traders -- a group that includes hedge funds, asset managers and others -- raised their bets against the greenback to some $8.6 billion, according to the latest Commodity Futures Trading Commission data released Friday. This group is now the most negative on the US currency since late July.

The dollar enters the week facing Washington gridlock and a data calendar dominated by the labor market. Tuesday’s JOLTS report is the only government release guaranteed, but beyond that the outlook is murky as the Bureau of Labor Statistics will suspend operations during a shutdown, putting Friday’s payrolls print at serious risk of not being released.

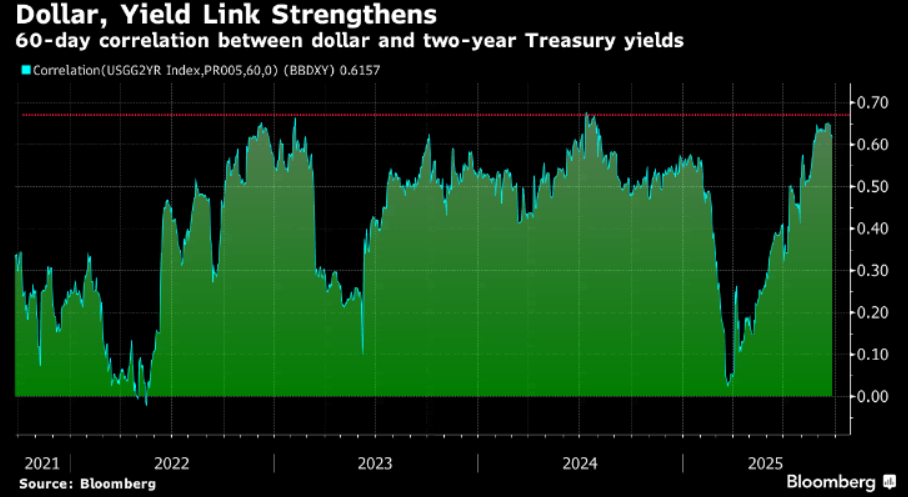

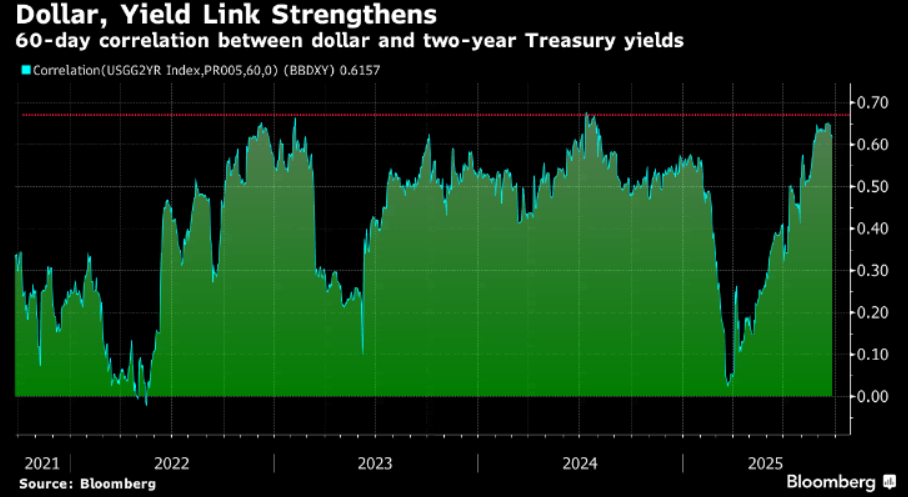

A shutdown itself historically tends to weigh on the greenback, though the impact is usually modest and short-lived. Short-term safe-haven Treasury demand into the shutdown can push yields lower, undermining the dollar at the margin. After a brief decoupling earlier in the year amid the “sell America” rush out of US assets, the greenback’s correlation to rates has snapped back, near 2024 highs on a 60-day basis.

Yet history shows the currency ultimately looks through the disruption, as economic activity lost during a closure is generally recovered in subsequent weeks. That dynamic leaves the dollar’s real driver this week squarely in the hands of the labor market.

Wednesday’s ADP report will therefore be treated with unusual seriousness. Once dismissed as unreliable and noisy, the series has proven much more accurate than previously believed following recent payrolls revisions, suggesting it could serve as a valuable substitute if payrolls fail to materialize on Friday.

The Bloomberg Dollar Index is effectively flat on the month, setting the stage for a fourth quarter that has generally fared poorly for the dollar. Since 2020, the BBDXY trades lower by roughly 1.8% on average in 4Q. That number would be even lower if not for the large rally in the greenback in 2024 following the presidential election, where the dollar soared 6.8% on Trump-related optimism. Those bets have since unwound.

Against this backdrop, the Fed’s shifting emphasis on the jobs market is crucial. Chair Jerome Powell and many of his colleagues have been clear that labor conditions now carry more weight than inflation. Further signs of softening could reinforce expectations of another cut in October, in-line with the recent September SEP.

This week’s tension ensures that however noisy the political backdrop may be, the tone of the dollar will be set not in Congress but in the employment data that does -- or doesn’t -- get released.