The following lines of Led Zeppelin’s Stairway to Heaven” apply beautifully to Takaichi & JPY:

There's a lady who's sure all that glitters is gold,

And she's buying a stairway to Heaven,

When she gets there she knows, if the stores are all closed

With a word she can get what she came for

Ooh, ooh, and she's buying a stairway to Heaven.

Takaichi has firm plans for JPY flying upwards to 160 levels. Her fiscal expansionary plans would ensure that every dip in JPY is bought. With her meeting with BOJ Chief Ueda yesterday, it seems even Jan’26 hike looks delayed further.

But where is the line in sand for Japan’s MoF. We believe it is the 159-160 band.

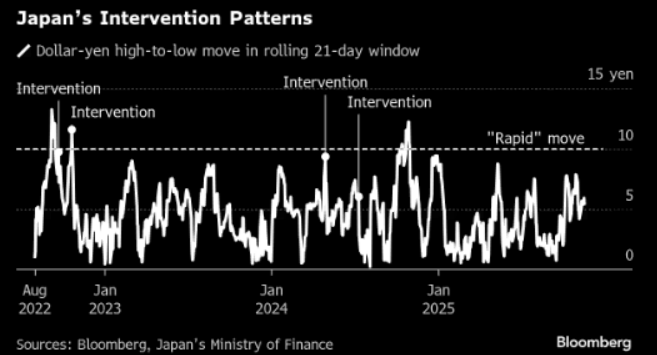

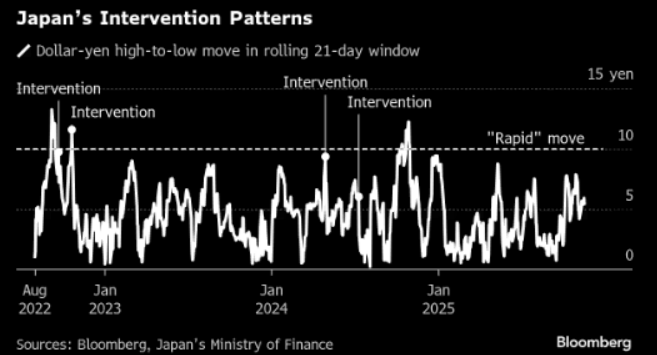

Back in February 2024, then-currency chief Masato Kanda described a 10-yen move against the dollar within a month as rapid. Using that as a yardstick, we can build an intervention index measuring USD/JPY’s gap between the day’s high and the lowest point over the past 21 trading sessions. Tracking this gauge offers valuable clues on when Tokyo might next take action.

The pattern is striking: interventions in September and October 2022 and April 2024 all occurred when the index either approached or exceeded the 10-yen mark, underscoring the importance of volatility.

There was also action in July 2024, even though the gauge showed only a 6-yen gap. That move coincided with the USD/JPY’s ascent beyond 160 to a fresh multi-decade high, indicating that levels matter as much as speed

A more curious episode unfolded in October 2024, when the index surged to 12 yen but drew no response from the authorities. Two factors may explain the restraint:

Leadership shift: Kanda had stepped down in July 2024, possibly altering the ministry’s reaction function.

Diplomatic caution: Japan may have been extra cautious amid US political uncertainty in the run up to the presidential election stateside.

Now, with a new currency czar in Tokyo and a new president in Washington, Finance Minister Satsuki Katayama’s recent remarks hint that intervention risks are once again on the rise.

We will watch the following key USD/JPY levels:

158.87: Year-to-date high set on Jan. 10

160: A quick move here would push the intervention index toward the 10-yen “rapid move” threshold

161.95: The weakest level since 1986, marked in July 2024

Japanese assets are also having a rough time of it because of JPY’s fast depreciation. One reason may be that the yen’s decline has been so steep that what’s often a positive for equities is turning into a neutral or even a negative. USD/JPY jumped since Prime Minister Takaichi shifted toward looser fiscal policy earlier this month, but the latest bout of currency weakness has been accompanied by a slide in equities as well.

While some of the drop for stocks was driven by a more general malaise, the Nikkei 225’s 4.3% loss since then is the worst among major indexes. The Topix has suffered less, with a 1.9% decline which is only slightly deeper than the 1.6% fall for the MSCI All-Country World gauge. And f you put the Topix into dollars to match the MSCI benchmark, it dropped twice as fast as global equities.

With JGBs also sliding, the yen’s struggles underscore concerns that Japan is losing control of its policy mix, as Brendan Fagan highlighted. today’s 20-year bond auction will bring a fresh pressure point on that front.

Certainly, there have been previous episodes when yen declines turned into a headwind for the country’s equities rather than a tailwind, and it looks like we are in the middle of another one.

The bigger question is: Is Takaichi headed the Liz Truss moment of reckoning?