IMF’s unique data on the currency composition of global foreign exchange reserves, COFER, track how much of the world’s reserves are held at central banks in different currencies—such as the US dollar, the euro, Japanese yen, Chinese renminbi, British pound, and others. The data are based on voluntary, confidential reports by 149 economies.

But a crucial detail is often overlooked: these shares are reported in US dollars. This means that if a country holds reserves in euros or yen, the value of those holdings is first converted into dollars before being added to the global totals. So, when exchange rates shift—even if no central bank buys or sells anything—reported shares change.

This year, exchange rate shifts have been noticeable.

A. The DXY index—a benchmark measure of the US dollar’s performance against the euro and the currencies of Japan, the United Kingdom, Canada, Sweden, and Switzerland—fell more than 10 percent in the first half of the year, its biggest drop since 1973.

B. The dollar depreciated by 7.9 percent against the euro in the second quarter, and by 10.6 percent in the first half.

C. It fell by 9.6 percent against the Swiss franc in the second quarter, and by more than 11 percent in the first six months, its weakest first-half performance against the franc in more than a decade.

This means that even if central banks made no changes to their portfolios, the value of their non-dollar holdings—when expressed in dollars—increased, resulting in a corresponding decrease in the share of dollar holdings.

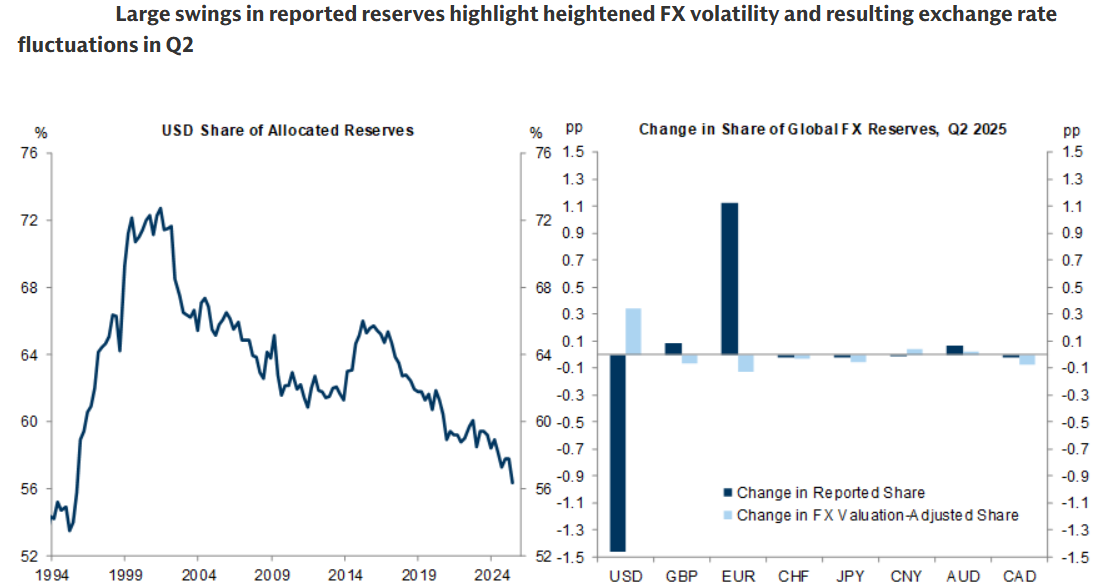

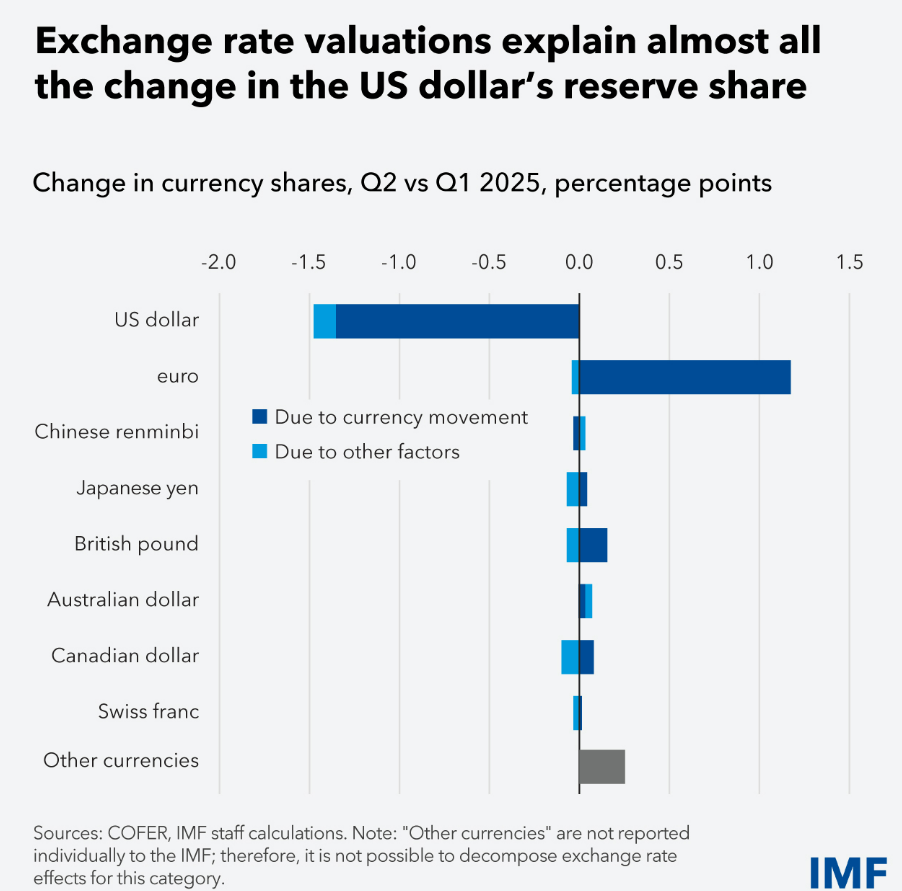

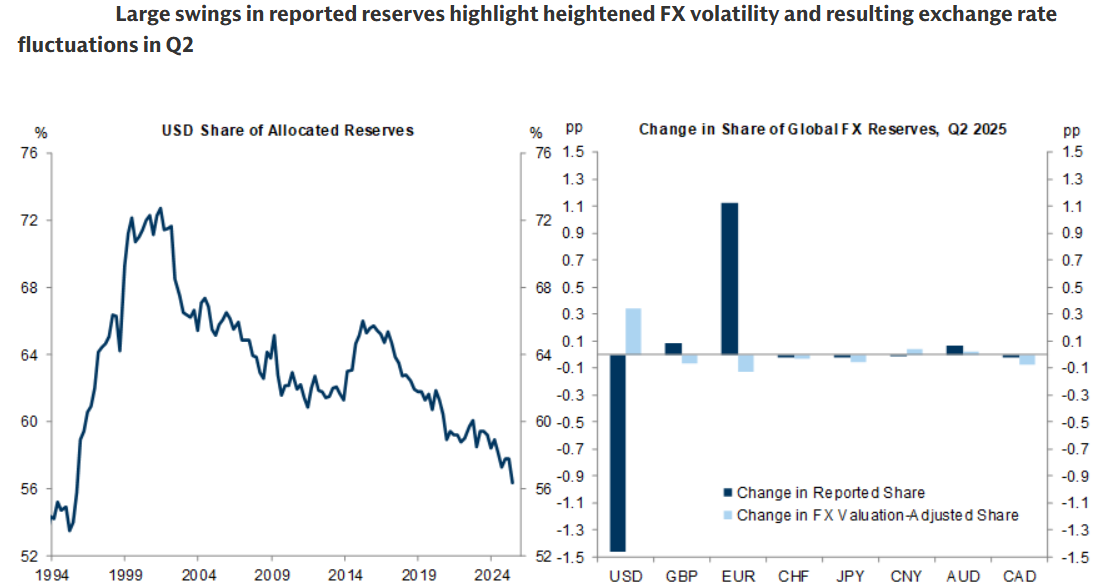

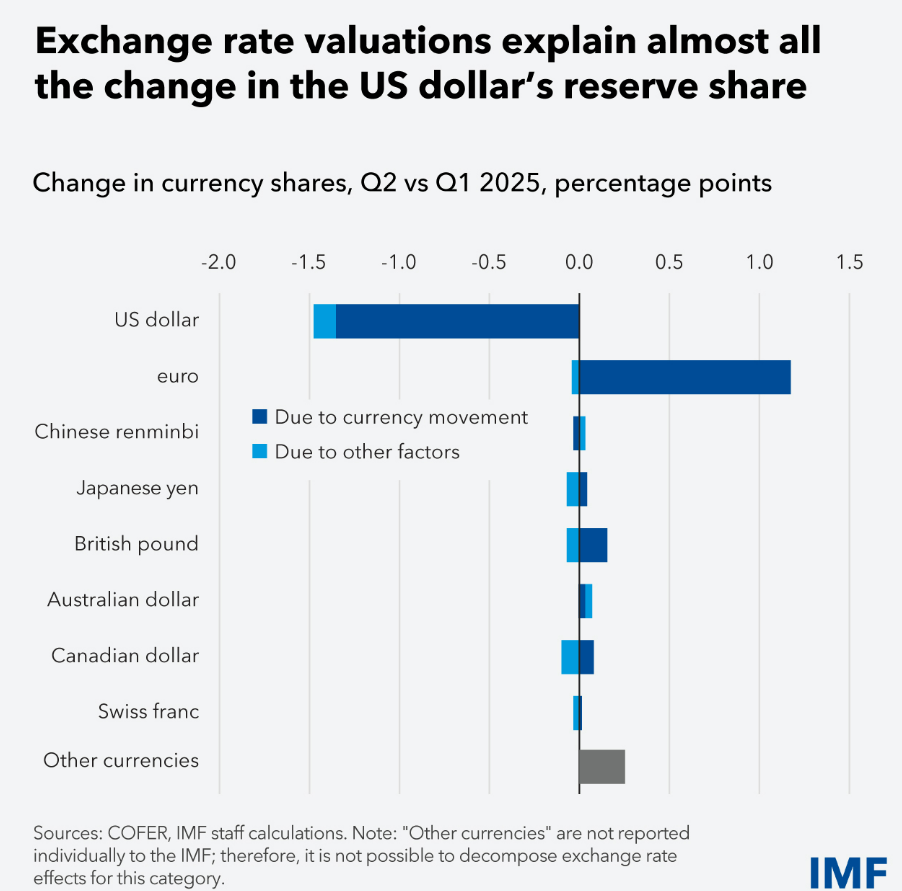

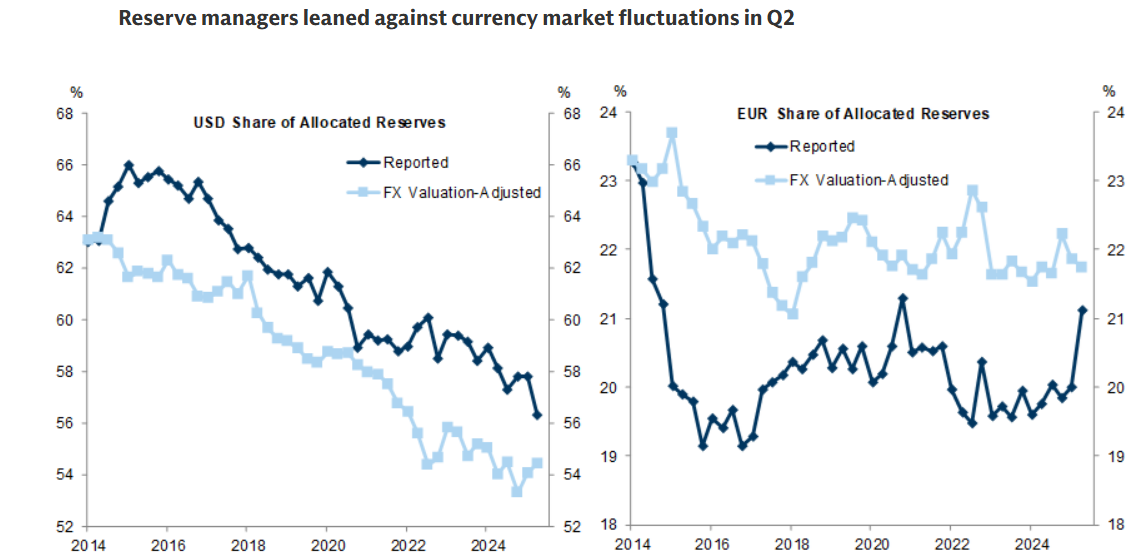

The raw data suggest a drop in the dollar’s share of allocated reserves to 56.32 percent at the end of the second quarter from 57.79 percent at the end of the first quarter, down 1.47 percentage points. However, by holding exchange rates constant, its share would have fallen only slightly to 57.67 percent.

Currency movements explain 92 percent of the reduction of the dollar’s share during the three months through June.

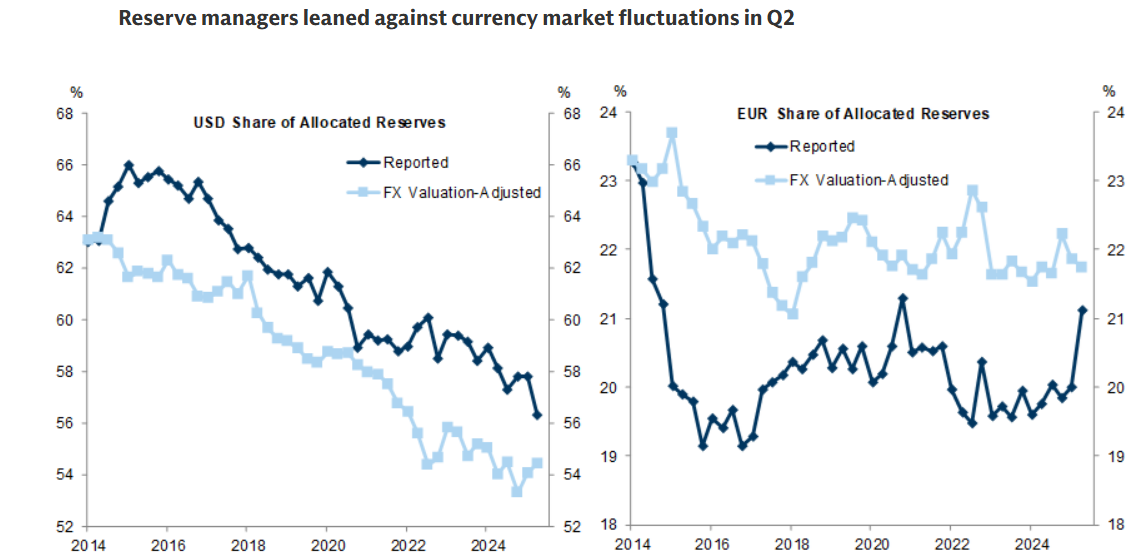

In contrast, the headline share of Euro reserves increased meaningfully while the valuation-adjusted share of Euro reserves declined slightly. For both Dollar and Euro reserves, FX valuation adjustment suggests that reserve managers leaned against currency market fluctuations.

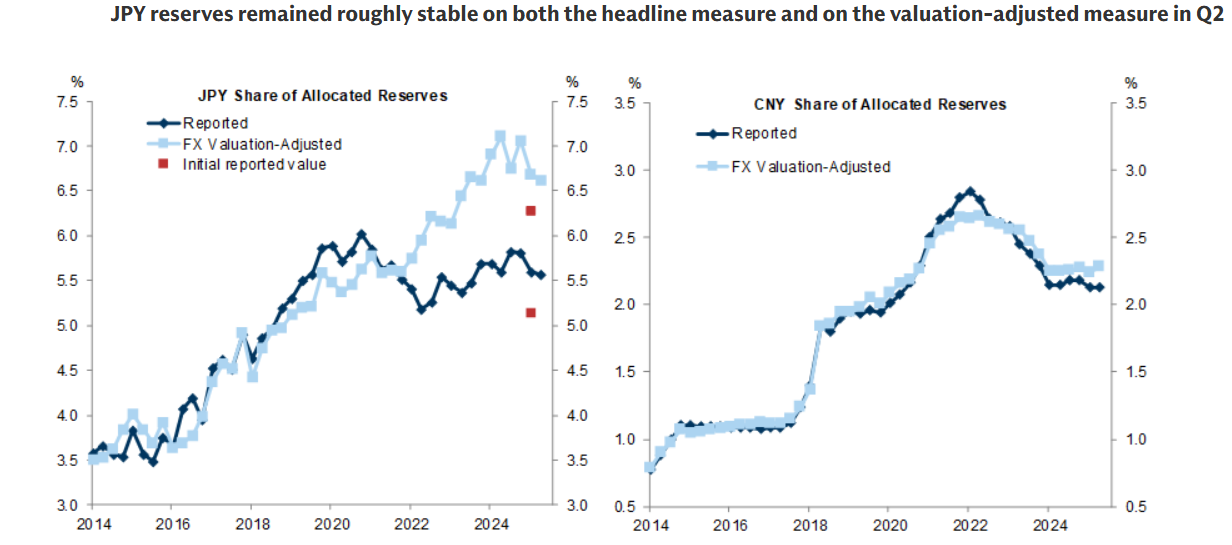

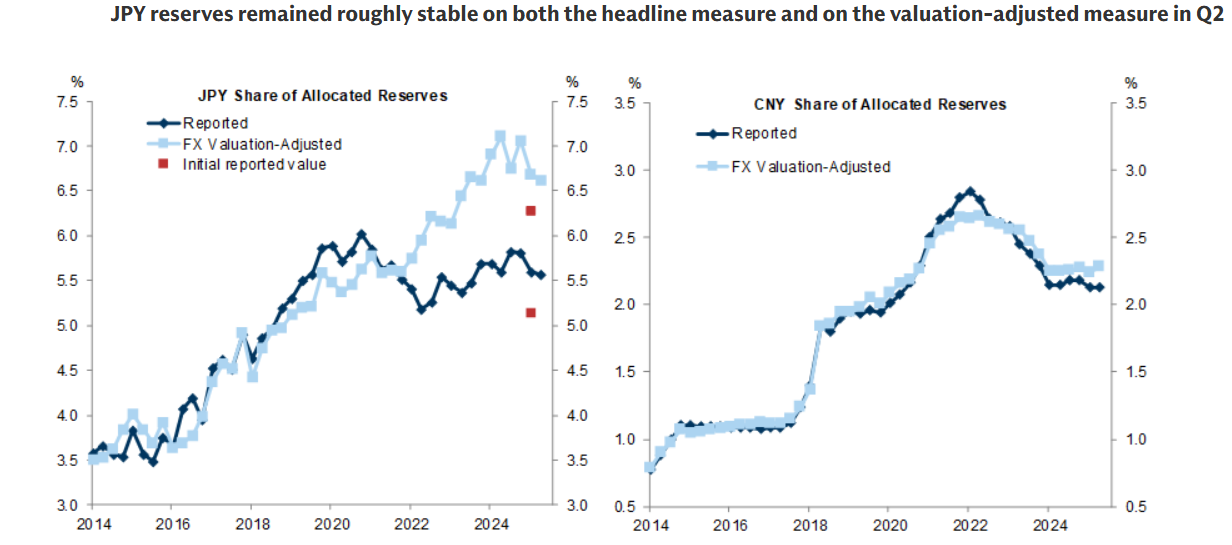

JPY reserves remained roughly stable on both the headline measure and on the valuation-adjusted measure in Q2. While the initial Q1 print reported that JPY reserves saw a significant decline on both the headline and valuation-adjusted measures in Q1, this data has since been revised to show much less of an outsized decline.

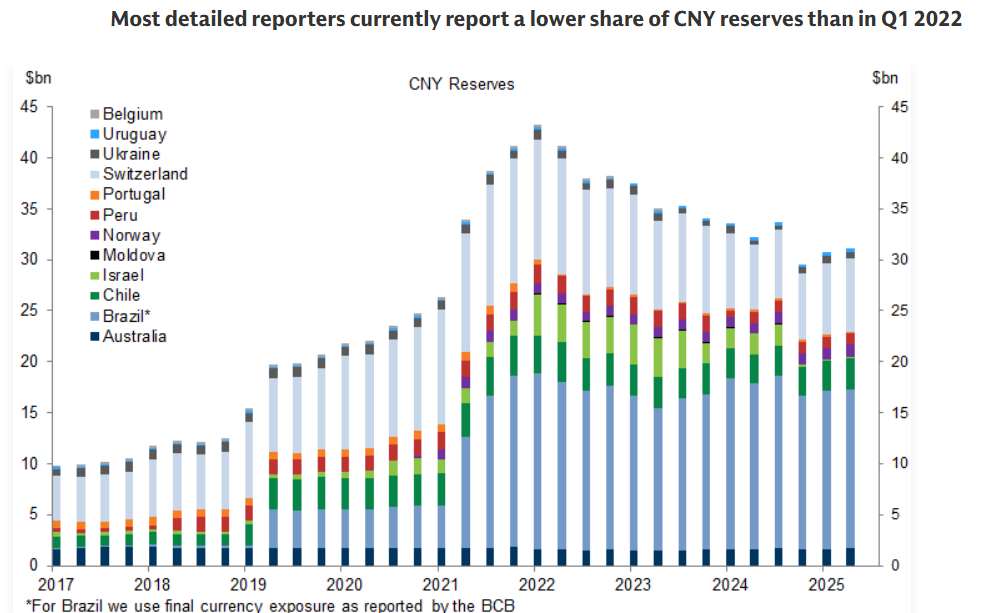

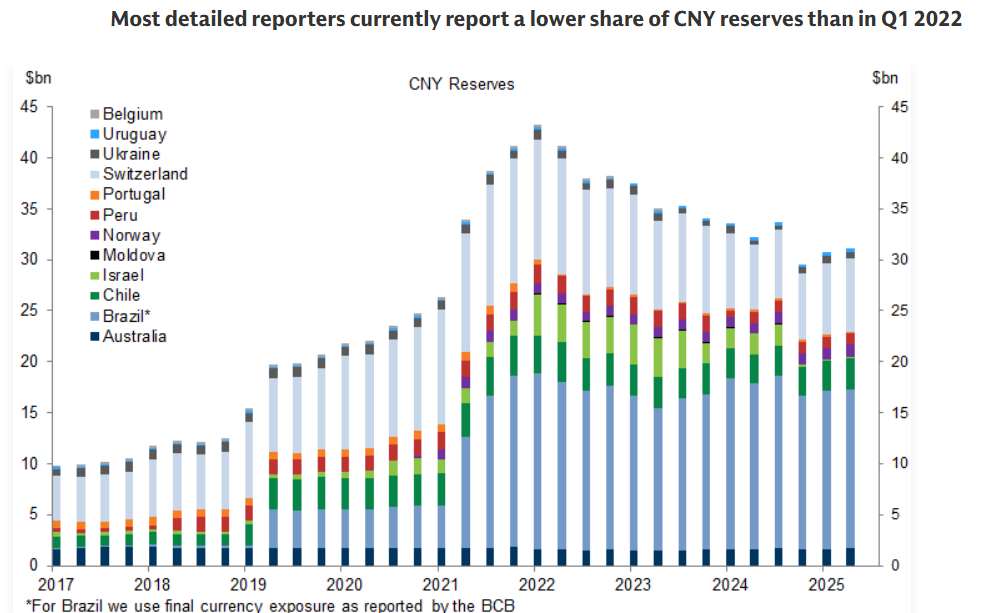

Both the headline and valuation-adjusted share of CNY reserves remained stable in Q2. CNY reserves have remained nearly flat since Q1 2024. Allocated CNY reserves have decreased by around $75bn since the start of 2022. Of the countries that regularly report a geographic breakdown of their reserve holdings, most currently report a lower share of CNY reserves than in Q1 2022.