The US dollar is accelerating its move to hero from zero, surging against all its major peers this week. The move gained fresh oomph overnight as gold tumbled, along with Bitcoin. The growing momentum for the greenback is spurring fresh squeeze for overstretched dollar bears.

But people are not suddenly starting buying dollars out of bullish enthusiasm, but more because of proactive reasons to sell most of its leading competitors. The latest shift underscores the importance of the crossover into a setup where the dollar is again looking like the least bad major FX asset.

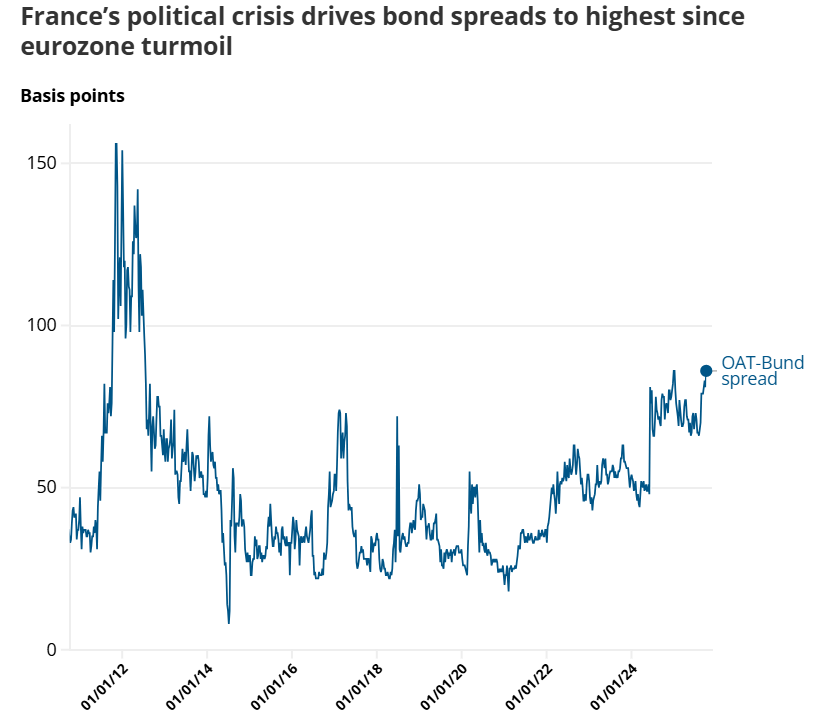

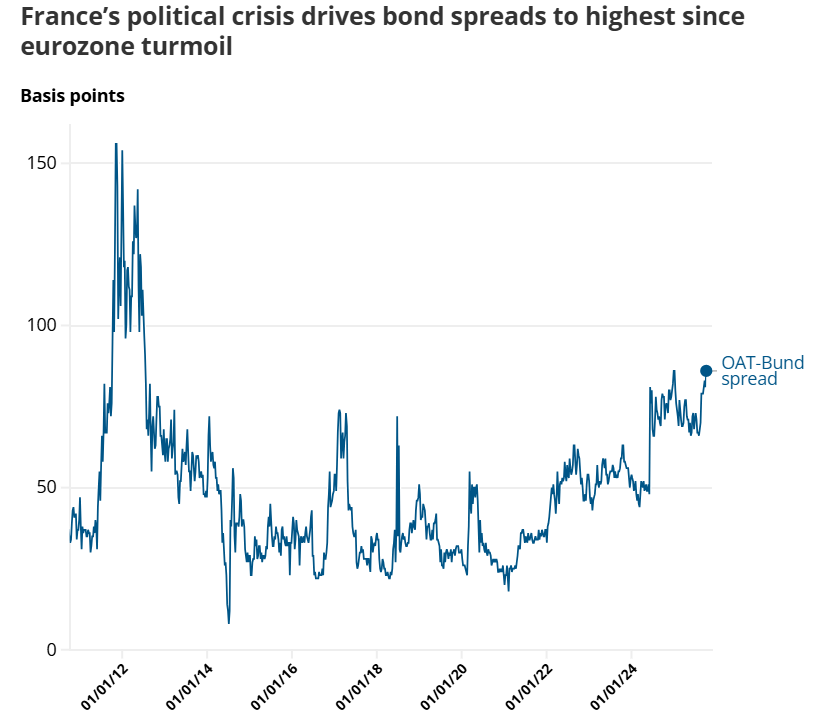

French politics shot EURUSD: If we look at Europe, France’s political crisis is fuelling economic and market uncertainty, with risks to growth and compliance with EU borrowing rules. Bond spreads have widened, reforms are stalled, and even the ECB may need to act if the situation continues to deteriorate.

The sudden resignation of Prime Minister Sébastien Lecornu two days back, less than a month into the role, has left the government without a working majority at a time of rising fiscal pressure.

With no roadmap for resolving the deadlock and President Emmanuel Macron facing mounting calls for fresh elections, continued uncertainty could jeopardise compliance with EU fiscal rules as Brussels sharpens its oversight.

At the time of writing, yields on 10-year French government bonds (OATs) are now trading around 82 basis points above their German equivalents, a spread last seen during the collapse of the Barnier government in late 2024.

Current levels also on par with those seen in July 2012, during the final stages of the Eurozone debt crisis.

The real risk lies in the potential for snap elections, which we see as the “the most harmful scenario for the euro in the short to medium term”.

Takaichi Shot JPY: Markets have responded to Sanae Takaichi’s victory with the so-called “Takaichi trade,” weakening the yen to current 153 levels from 147 levels pre-election results. Takaichi has been widely labeled as an apostle of “Abenomics,” the economic strategy of Abe, which espoused loose monetary policy, fiscal spending and structural reforms. During last year’s ruling Liberal Democratic Party leadership race, she criticized the Bank of Japan’s plan to raise interest rates and, by extension, strengthen the yen.

To summarise, Euro and Yen rolled over earlier in this week as political risks came to the fore in those economies. This has led to the sudden strength in DXY.