Confidence among Japan’s large manufacturers improved for a second straight quarter, supporting the case for the Bank of Japan to raise interest rates in it’s 30th Oct meeting. This has been our view for the past few months but it has been delayed due to local political issues.

The business sentiment index climbed to 14 from 13 in the three months ending September according to the BOJ’s latest quarterly Tankan business survey Wednesday. That matched the median economist forecast in a Bloomberg survey.

The gauge for large non-manufacturers remained at 34, near the highest level since the early 1990s. A positive figure indicates that those who see business conditions as “favorable” outnumber those who said “unfavorable.”

The overall outcome of the Tankan, one of the most closely watched data by the BOJ, offers support for a case of rate hike in the Oct meeting itself. Governor Kazuo Ueda has stressed the need to examine the weight of the US tariffs on business activities and corporate earnings. The Wednesday report signals no dire effects so far.

We also note that BOJ Deputy Governor Shinichi Uchida in his comments today reaffirmed the Bank of Japan’s standing policy to raise benchmark interest rates if the economy performs in line with forecasts, in comments a day after the release of the Tankan survey.

He commented “If the outlook for economic activity and prices is realized, the bank will continue to raise the policy interest rate and adjust the degree of monetary accommodation accordingly,”

He also said ““corporate sentiment has improved in some parts of the manufacturing sector and, overall, it’s staying at a favorable level reflecting the view that uncertainty regarding the outlook has eased following the U.S.-Japan tariff deal.”

The reiteration of the above policy stance is likely to support speculation that authorities may hike rates when they next set policy on Oct. 30. By declaring that the BOJ’s Tankan survey released Wednesday indicated that business sentiment is at a favorable level, Uchida appeared to be suggesting that the report showed the economy is developing in line with the bank’s outlook.

BOJ watchers give particular weight to Uchida’s remarks as he is known to have played a key role in plotting and executing monetary policy for more than a decade as a veteran central banker.

Speculation over the prospects for a rate hike has gained momentum after two board members dissented from keeping the policy rate on hold at 0.5% last month, calling instead for a hike. Also, board member Asahi Noguch, considered dovish, pointed to the rising need for an interest rate hike in comments earlier this week.

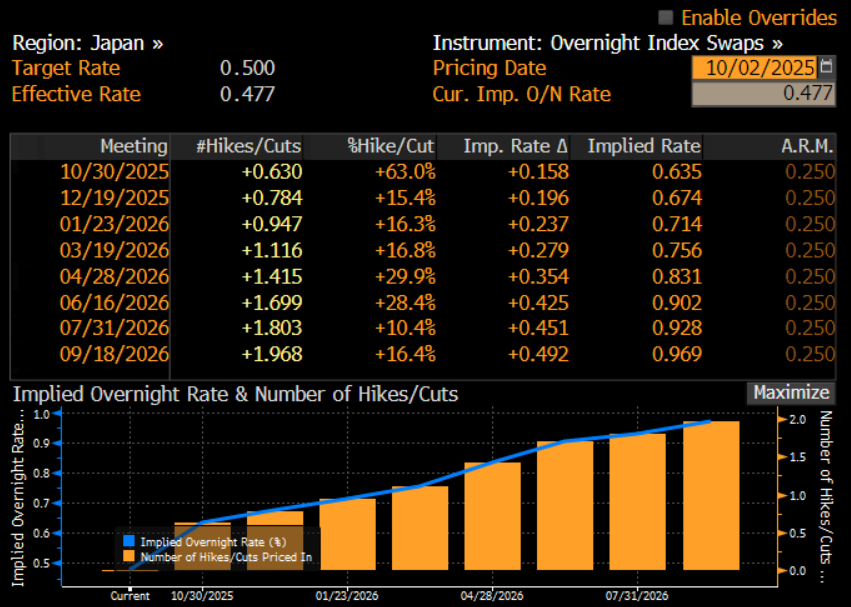

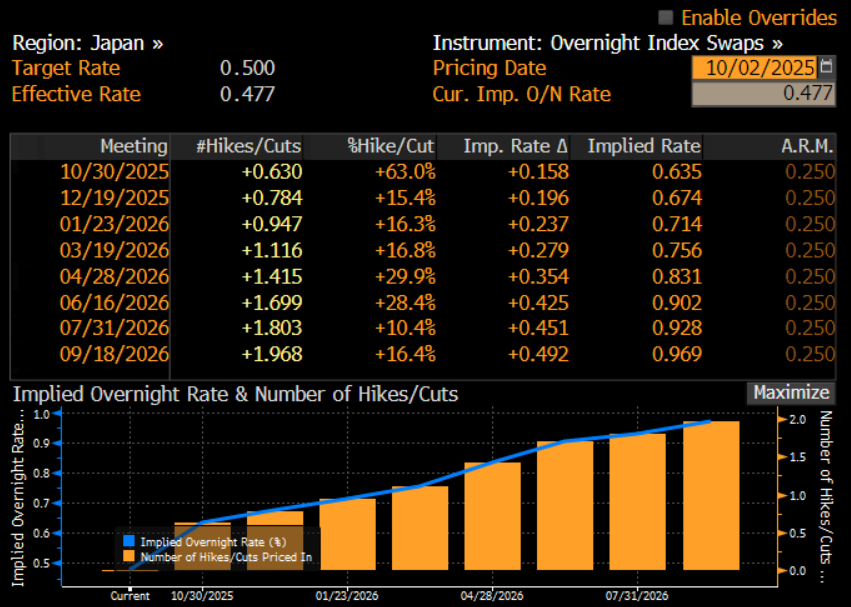

Swaps traders are now seeing about a 63% chance of a rate hike at the Oct 29-30 gathering.

We believe JGB curve might flatten going ahead as BOJ hikes in the Oct meeting. JGBs will also suffer from the BOJ scaling back purchases in maturities from one-to-10-years, which will weigh on the short end.

On JPY itself, we believe that it is headed towards 140 by Dec’25 and likely to break this key support levels if our view on front loaded cuts by Fed, i.e. 4 cuts of 25 bps each in next 4 meetings materialise as Fed is likely to focus more on it’s employment mandate than the price stability goal and treat inflation as a one-time shock.

The only risk to our view is if in the 4th Oct LDP leadership elections, Sanae Takaichi wins over Shinjiro Koizumi. On the other hand, a victory for Koizumi could potentially catalyse more JPY strength, given that he is perceived as more supportive of Bank of Japan (BoJ) policy normalisation than Takaichi, and that the market does not seem to be actively positioning long JPY.

A Kyodo News poll of LDP supporters eligible to vote, conducted on 27-28 September, showed Takaichi with a slight lead (34%) over Koizumi (31%), followed by Yoshimasa Hayashi (13%).

The poll also found that Koizumi has the support of over 80 lawmakers, almost double that of Takaichi, while Hayashi has the support of roughly 60 lawmakers. The latest Nikkei Shimbun poll of self-described LDP supporters yielded slightly different results, with Koizumi (33%) leading Takaichi (28%) and Hayashi (20%). We think Koizumi can edge out Takaichi if his support among lawmakers, who are critical to the run-off result, materialises.

Summary: Recent Japanese economic indicators have showed that local economy is performing well in spite of US tariff effects on Japanese exports but inflation is running consistently ahead of it’s 2% target. Hence the much delayed 25 bps rate hike from BOJ can be expected in it’s 30th Oct meeting. Recent political issues have delayed the rate hike but assuming Takaichi does not win, we see strong probability of 25 bps rate hike by the BOJ in the October meeting.