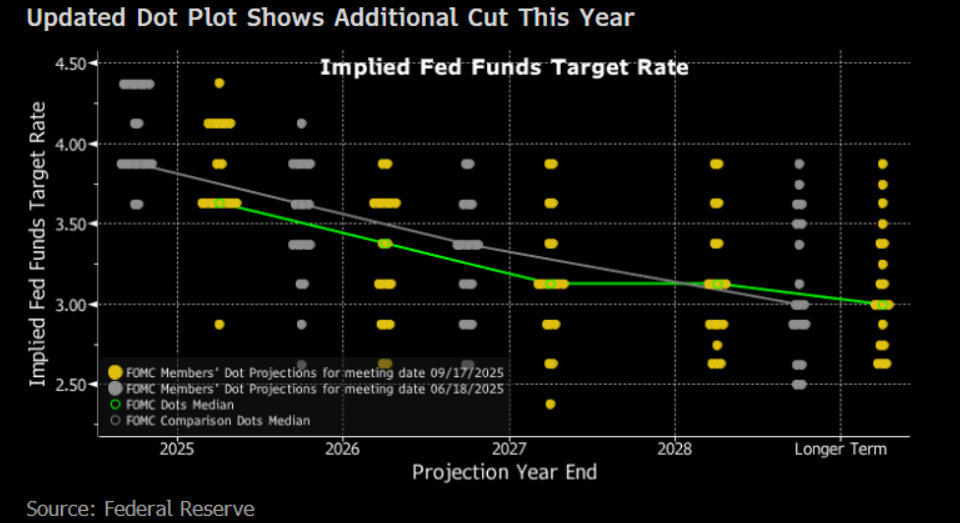

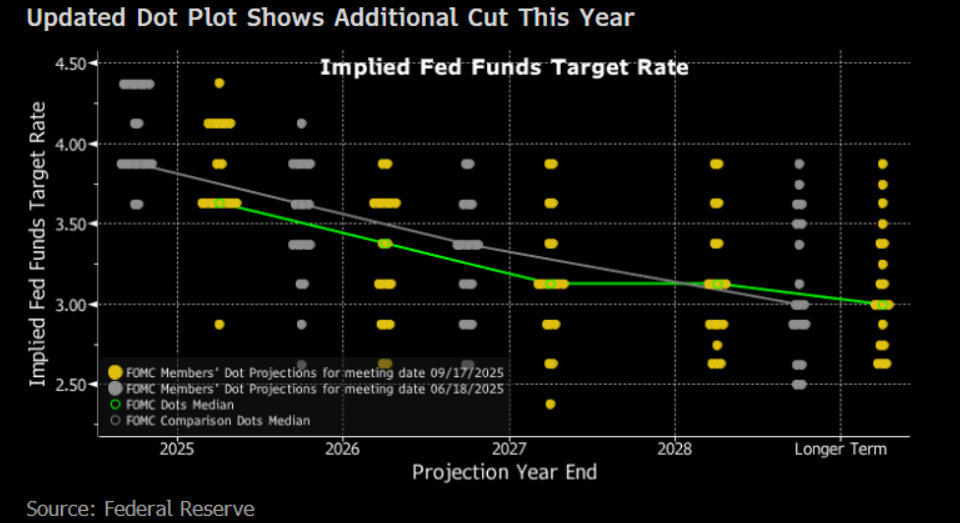

The much-awaited FOMC meeting today yielded a 25-bps cut in the Fed funds rate to 4.0%-4.25% — as widely expected — the first cut since December’24. The median participant sees another 50 bps of cuts this year — 25 bps more than in the last version — and still anticipates 25 bps of cuts in each of 2026 and 2027. The updated dot plot shows a divided FOMC, with almost as many officials anticipating just one or even no additional cuts this year as those expecting further cuts.

In the above DOTS, one FOMC member shows CY25 year-end rates 25 bps above the post-meeting target range — which we take as a silent dissent by most likely Kansas City Fed president Schmid. Six FOMC member show no additional cuts in 2025. Two show one more 25-bp cut this year. Nine show 50 bps of further cuts this year. One (has to be new FOMC member Stephen Miran) shows an additional 125 bps of cuts in 2025.

The most dovish part of CY26 DOTS is that 2026 was almost 3.125% -- 9 dots at 3.125% or below, 10 above.

Moving on from DOTS we found the FOMC statement razor focussed on weakness in employment over higher prices. FOMC statement says “Job gains have slowed, and the unemployment rate has edged up but remains low.” It’s the first time this year the Fed hasn’t said that labor market conditions are solid. Instead, it says “downside risks to employment have risen.” Even during the press conference, Fed Chair Powell highlighted labor market softness as central to the FOMC’s decision: “I can no longer say” the labor market is “very solid,”

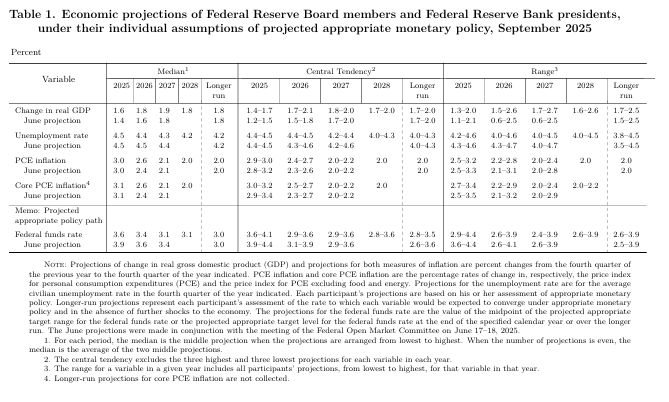

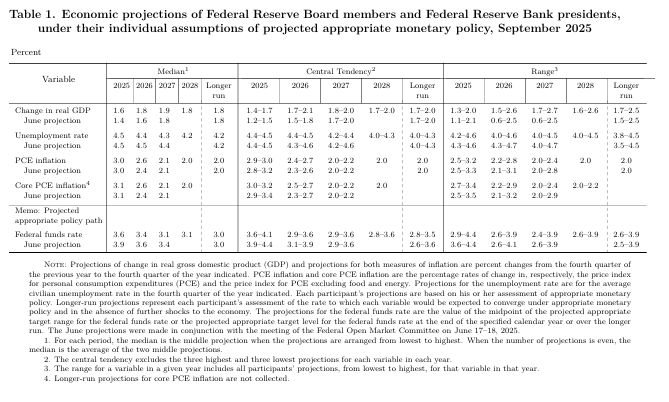

It is worth noting that the Fed is cutting rates, and projecting more rate cuts, at the same time as upgrading its growth forecast and nudging up its inflation outlook too. Clearly, it’s all about jobs.

But the policy statement and updated Summary of Economic Projections (SEP) display several other interesting contradictions.

The policy statement added language to flag increasing downside employment risks, while acknowledging that inflation has moved up. In contrast, officials marked up their growth estimate this year, and lowered the unemployment rate estimates in the SEP forecast horizon. (see table above)

On inflation, Powell said the case for a persistent breakout of inflation from tariffs is now less and this is what helped to allow the Fed to cut today. Powell said the risks since April (i.e., Liberation Day) of higher and more persistent inflation have eased.

But we believe Fed is in a tough spot. They expect stagflation, or higher inflation and a weaker labor market. That is not a great environment for financial assets. One could call the Fed’s move a risk management-style rate cut. It shows the Fed is putting more emphasis on the softening in the labor market as they trimmed rates while forecasting more cuts in 2025.

On the much talked about 3rd mandate of the Fed, i.e. moderate long-term interest rates, Powell said Fed thinks of this as essentially a result of achieving the first two mandates -- stable prices and full employment. So, there’s no thought to considering that long-term rates objective as a distinct thing to work toward.

Today’s outcome is probably as good a result as Powell could have hoped. There was potential for wide dissent from those who had been tipped to push for a bigger cut and by those who were seen as reluctant to cut. In the end, the dissent came down to Miran while the rest of the FOMC rowed in. It means Powell remains firmly in control of the narrative, at least for now.

Market implications: Fed can’t keep rates now at restrictive level considering the last 3-month average non-farm payroll (NFP) is 29k only. The risks to the US labor market were the focus of today’s decision. The speedy decline in supply and demand in the US labor market has led to the current situation. We estimate a neutral monthly NFP of 60k-75k for keeping unemployment rate (UR) constant around 4.3%. August NFP of 22k might only go further down (we believe it might be even -ve) as we move to October NFP coming on 7th Nov. We believe current tariff situation will lead to lower real income for US consumers leading to lower consumer spending leading to lower earnings for US corporates leading to layoffs which will finally tip off the current low demand low supply labor market into a recessionary labor market by end CY25. Much of the US economic growth in H1CY25 (almost 1% out of 1.4%) came out of AI capex. AI capex led growth leads to rise in productivity and loss of employment in general. We also believe that sooner than later, AI capex might slow down as equity markets question the RoI on these large-scale investments. Hence, we believe US GDP growth in CY26 will be materially lower than today’s SEP’s projection of 1.8%.

We continue to believe in another 50-bps cut in REMCY25 and another front loaded 50 bps cut in Q1CY26 bringing the terminal rate to 3%. This has been our view since June when market was pricing in only 40bps of cuts for REMCY25.

We believe DXY is headed lower for longer eventual target being 90 with 95 being the first stop. Currently it is at 97 levels. US bond yields remain receive on upticks. Gold and silver might continue to perform as inflation & trade uncertainty remains high. EM assets might do better than US equities.