In our 8th Oct blog piece titled “FED’S BALANCE SHEET REDUCTION MIGHT SOON END” we had argued that Fed’s QT was about to end as bank reserves had fallen below the psychological 3 TN USD mark.

Fed Chair in his speech today at the National Association for Business Economics (NABE)’s annual meeting, said the Fed may approach the stopping point for balance sheet runoff “in coming months.” We are pulling forward our forecast for the end of balance sheet runoff. We now expect the FOMC to announce at its January meeting that runoff will end in February.

Powell noted that there had been some signs that “liquidity conditions are gradually tightening” and said the Fed may approach the stopping point for balance sheet runoff “in coming months.” Powell also said that the FOMC’s plans for balance sheet runoff were “deliberately cautious” to avoid “the kind of money market strains experienced in September 2019.”

Powell noted that the Fed’s ample reserves regime has been very effective and allowed the Fed to maintain control of the fed funds rate “across a wide range of challenging economic conditions,” particularly during the great financial crisis. Powell said that transitioning back to a scarce reserves regime would likely result in heightened market volatility and noted that the Fed would lose control over rates if its ability to pay interest on reserves were eliminated. In discussing the FOMC’s decisions on balance sheet runoff in late 2021, Powell noted that the Committee “could have—and perhaps should have—stopped asset purchases sooner” but that doing so would not have “fundamentally alter[ed] the trajectory of the economy.”

Fed officials have been winding down the central bank’s balance sheet since 2022 a process known as quantitative tightening reversing trillions of dollars of asset purchases designed to stimulate the economy after the pandemic struck. Earlier this year, the Fed slowed the pace by reducing the amount of bond holdings it lets roll off every month. The current pace of the Federal Reserve's quantitative tightening (QT) is $40 billion per month, a rate that was established in April 2025. This includes a monthly cap of $5 billion for Treasury securities and a $35 billion cap for mortgage-backed securities (MBS), a significant slowdown from the previous pace.

As bank reserves come down, there’s been prolonged funding pressures in US money markets suggesting the central bank may be getting closer to the point where it aims to halt the runoff.

Fed officials till recently appear divided over how low they could take bank reserves while avoiding market volatility. Fed Vice Chair for Supervision Michelle Bowman said at the end of September the Fed should seek to achieve the smallest balance sheet possible, with reserve balances at a level closer to scarce than ample. Governor Christopher Waller has said an optimal level of reserves would be around $2.7 trillion.

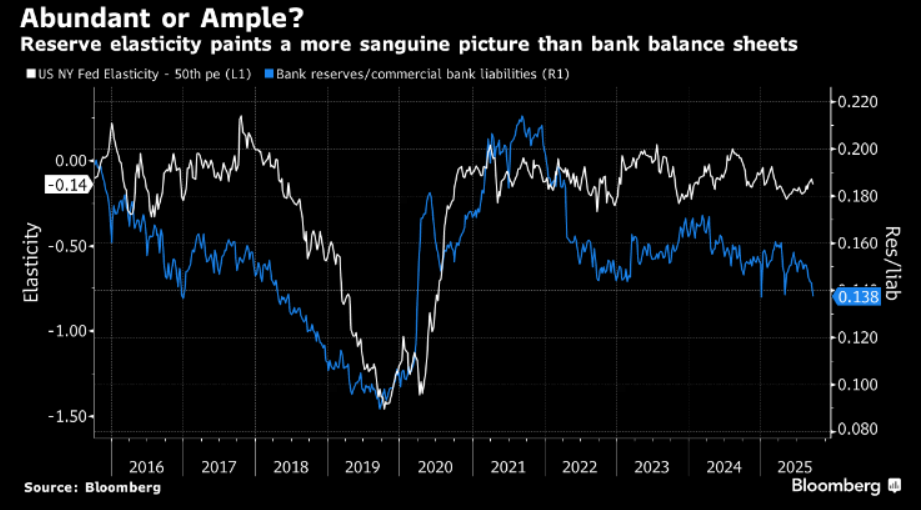

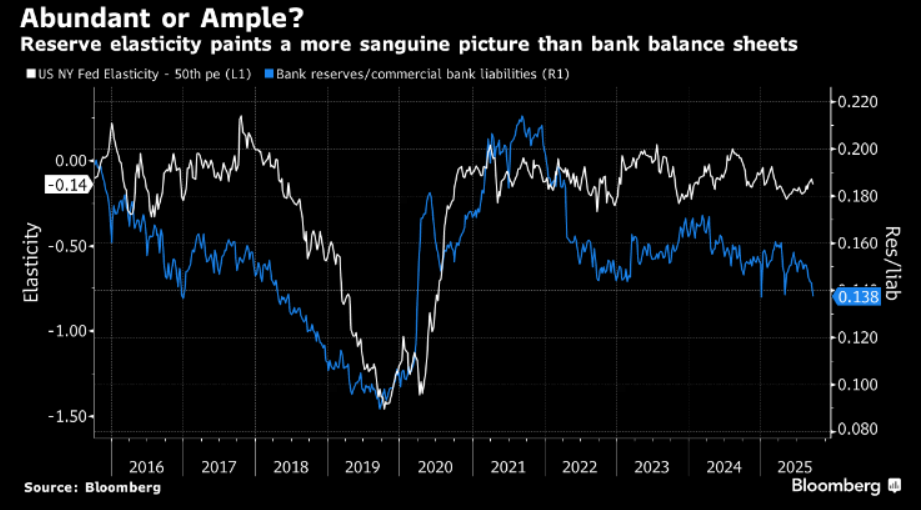

The aggregate level of reserves had fallen below 14% of total commercial-bank liabilities. In 2018, this was the threshold at which we saw funding spreads (effective Fed funds, repo, etc) start to rise, and so we have used it as a sort of shorthand to delineate the boundary between ample and abundant reserves. This level also coincided with a downward tilt in the Fed’s own reserve-elasticity metric seven years ago. At the moment, however, the reserve-elasticity measure is still in highly-comfortable territory even as bank reserves as a percentage of liabilities reach potentially significant levels.

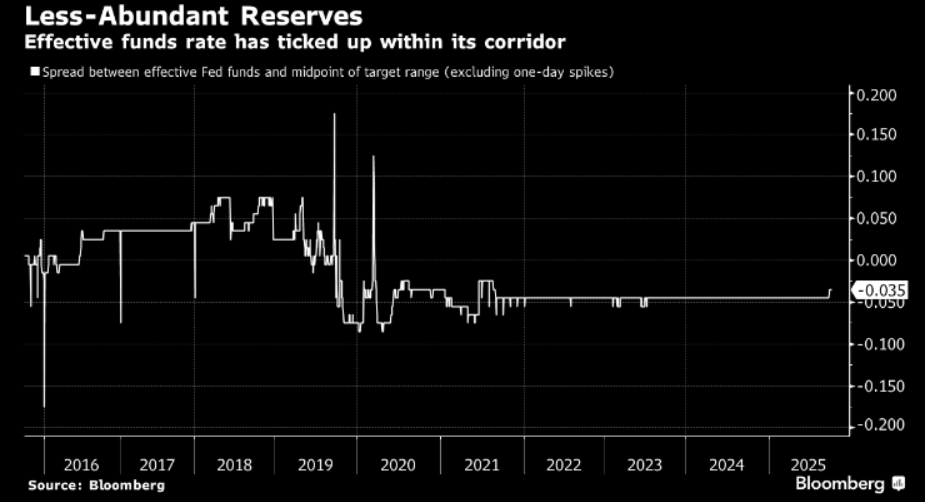

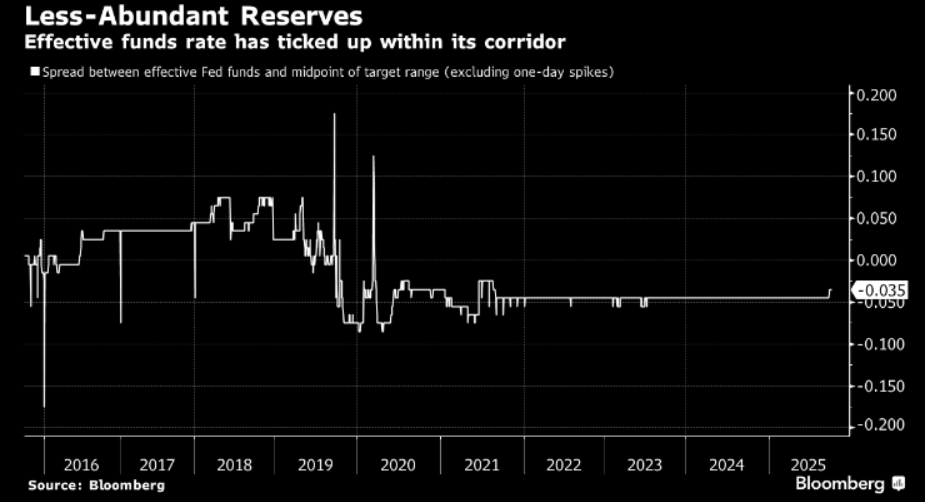

But something has changed recently, with effective funds now trading 3.5 bps below the target-range midpoint rather than the 4.5 bps that prevailed over the past four years or so. Hence the need for Fed to start preparing an end to QT.

Summary: End of QT augurs well for risk assets as well as long end USTs. We see 10yr UST yields falling to 3.85 from current 4.05 and 30yr UST yields falling to 4.35 from current 4.62 by Q1CY26. In our opinion piece “Is the US long end over valued” on 4th Oct we had argued the case for 30yr UST to fall to 4.35 from then levels of 4.75.

https://macro-spectrum.com/opinion/is-the-us-long-end-undervalued