The market has pivoted back to selling equities as an AI-led unwind rather than a clear macro shock sent the S&P 500 below a key area of recent support.

Early in the week, the rotation looked healthy: capital left pricier AI winners with higher realized vol and flowed into steadier names with more defensive cash flows, all without hurting index performance. That changed on Thursday. Even with solid results from Cisco, the AI complex cracked. Hyperscalers, chip suppliers, and the power-plumbing cohort sold off broadly, shaking risk sentiment and driving cross asset correlation higher in what looks like methodical de-grossing.

There was no single headline. Rather, doubts swelled around how more than now $3 trillion of pledged AI capex turns into cash flows on a reasonable timeline. Monetization is one lag; power is the other. Data centers go up in a year or two, but the grid that will power them takes longer to build. On-site gas and long-term direct-connect deals help, but turbine and other component backlogs and rising power costs push paths to profitability further out.

Add a faster chip-innovation cycle and rising power constraints, and you get shorter hardware lives that need faster depreciation- a dynamic that weakens the asset side of hyperscaler balance sheets just as they are increasing leverage. It’s a combo that will cloud firms’ future capacity for buybacks that have supported the equity rally since the lows of 2022 by providing a mechanical bid and dampening volatility.

Positioning and flows now skew as more of a headwind as the AI secular saga enters a new stage. The size of the drop in indexes likely forces systematic investors to cut exposure: CTAs, vol-control, and risk-parity all reduce net exposure on days like Thursday and overwhelm any dip-buying among the retail crowd. The addition of risk last week, seen in rising call skews, reversed, pushing dealers to chase the move lower. That said, for all the spot declines, vol remains contained, and that indicates a reduction in positions not a rush to hold and hedge.

Still, the macro narrative isn’t helping. The loss of official labor data reminds market participants they are driving partially blind for longer than thought, right as second tier readings like Challenger and ADP have been increasingly negatively. This is prompting consumer credit concerns to grow, leading publicly-traded consumer financing stocks to underperform.

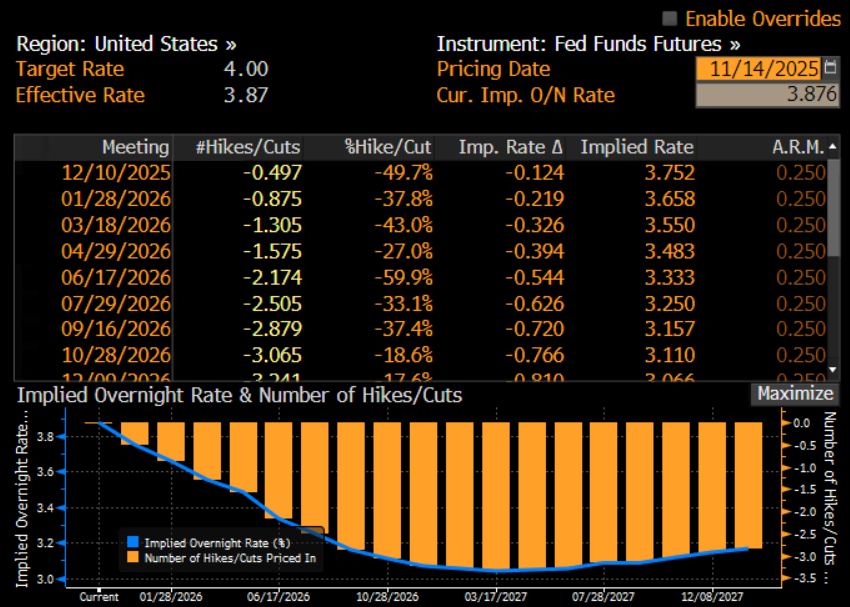

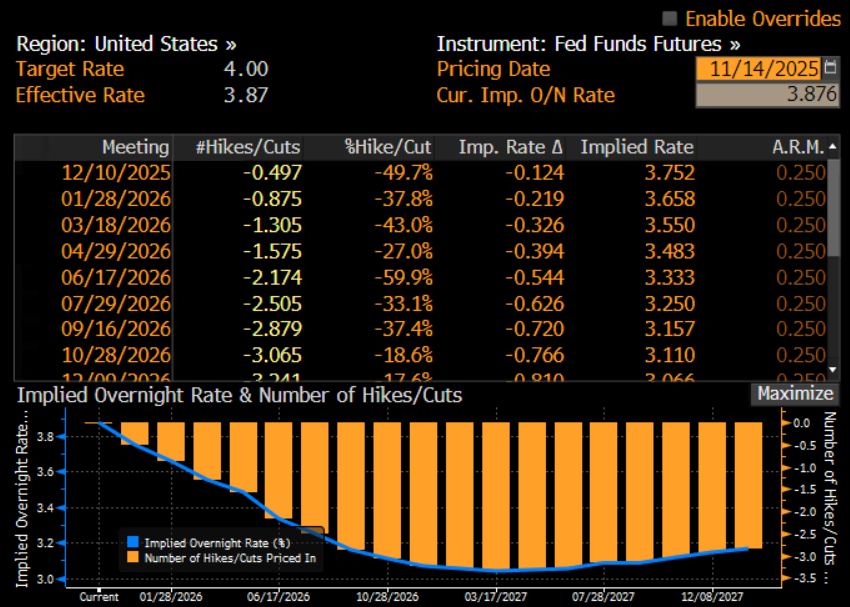

At the same time, Fed officials sound defiant and seem done delivering their safety rate cuts before getting clarity that the economy is, well, safe. St. Louis Fed President Alberto Musalem and Cleveland Fed President Beth Hammack added to the chorus of more hawkish comments this week, following NY Fed SOMA Manager Roberto Perli ironically teasing balance sheet expansion would be starting soon due to reserve scarcity. The Dec rate cut probability has now gone below 50%.

While markets have been hit with similar hiccups in the last few weeks, it increasingly looks like the year-end rally will be resting on next week’s Nvidia earnings and hope that the AI capex narrative can find meaningful footing again.