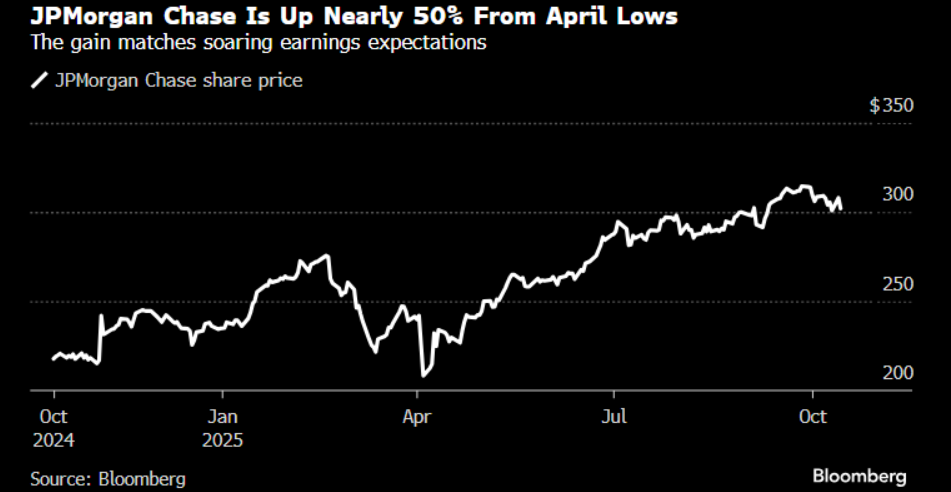

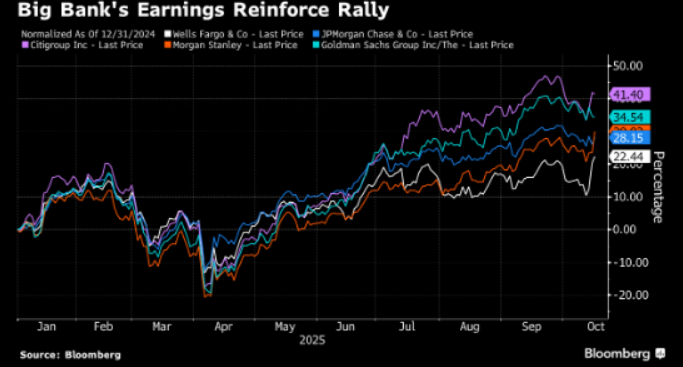

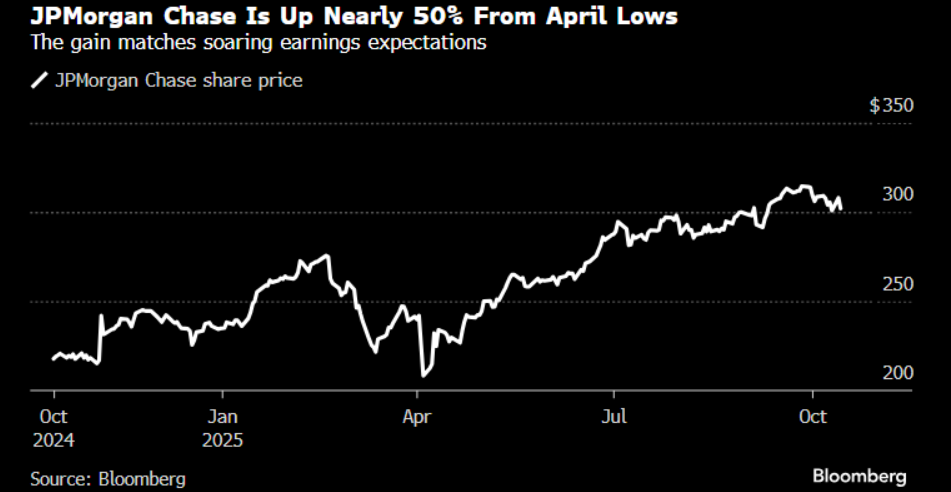

Amongst the US bank Q3CY25 earnings released yesterday, JPMorgan Chase & Co. was first out of the gates with a strong third-quarter. Trading and investment-banking fees were much higher than analysts expected, as was net interest income. The investment bank raised the full-year outlook as well.

Jamie Dimon, speaking on the JPMorgan conference call, said “we may be seeing peak private credit.” He was answering a question about the possibility of buying a private-credit firm.

He also did not sound optimistic on EUR. “The EU has a huge problem at the moment,” He said in relation to the region’s sluggish growth. “Europe has gone from 90 per cent US GDP to 65 per cent over 10 or 15 years. That’s not good. You’re losing.”

Separately, CFO Jeremy Barnum said “the US consumer basically seems to be fine.” There are mixed signals, he said, with more signs of stress in lower income bands and consumer spending growth has slowed, consistent with a soft landing.

It was no different at Bank of America, the second-largest American bank. The highlight was investment-banking revenue rising a whopping 43%, with net interest income also climbing 9.1% ahead of analyst expectations.

The bank’s traders also beat estimates, thanks to strength in the equities business, which rose 14% to $2.27 billion. Fixed-income revenue also increased, gaining 4.6% to $3.08 billion

Citigroup Inc. too beat Wall Street revenue estimates across all five of its major business lines, with total revenue jumping 9% as its markets, banking, services, wealth and US retail divisions all set records for a third quarter.

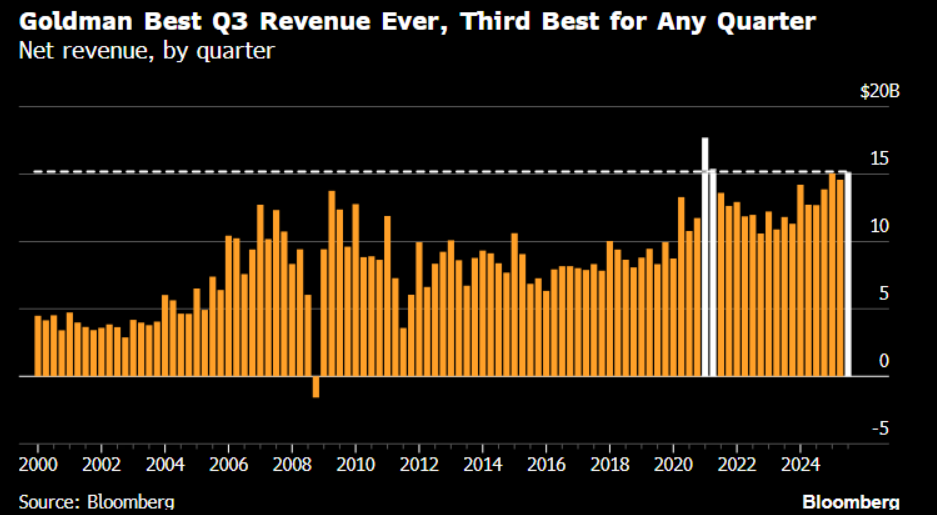

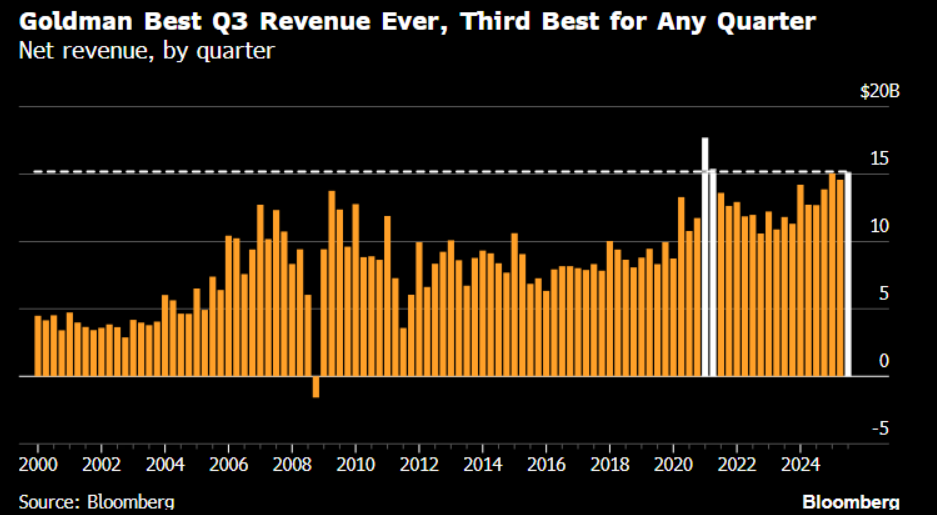

Goldman Sachs Group Inc. posted record third-quarter revenue boosted by a rapid pace of growth in its investment bank. The firm reported $2.66 billion in investment banking fees, a 42% surge on the same period last year, and revenue of $15.18 billion, its largest haul for that quarter in its history.

The outlooks from Wells Fargo & Co and Morgan Stanley also confirmed the same picture: an upbeat trading and investment environment, albeit with some provisioning for slightly tougher economic conditions ahead.

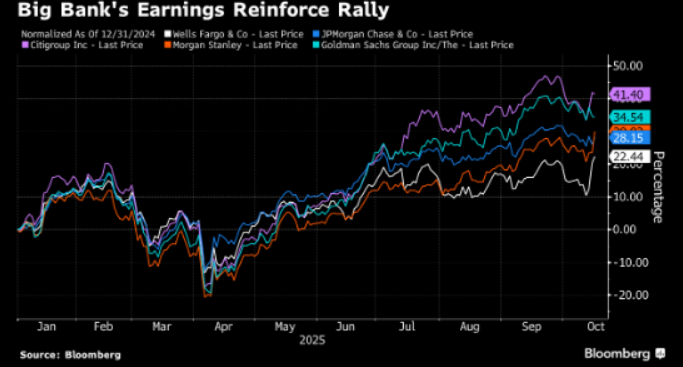

Earnings season has, so far, produced no red flags emerging for the US consumer. With the last of the big banks reporting earnings Wednesday, the post-April rally in financials looks set to continue.

Third quarter earnings results from the largest banks indicated households remain a positive factor in the financial system: they’re spending steadily, paying their debts, and keeping deposits stable.

Consumer credit remains in a positive trend with losses normalizing -- not deteriorating -- giving bank executives a reason to sound more confident about 2026. JPMorgan CFO Jeremy Barnum called consumer delinquency trends “favorable,” while Bank of America CFOAlastair Borthwick said charge-offs fell 10% in the quarter signs that the feared credit deterioration never materialized.

Auto lending came in better than expected, with BofA describing its auto credits as “sound.” Home lending remains subdued but is stabilizing. Both Wells Fargo and BofA said volumes are declining less sharply as affordability slowly improves with no signs of stress in mortgage credit.

Banks characterized credit metrics as normalizing back to pre-Covid averages, not moving towards any signs of real stress. With a rise in card charge-offs already baked into guidance, a real deterioration would mean 5% or more -- and no bank is seeing that.

Wells Fargo, Citi and JPMorgan all said prime borrowers dominate their books, with 80%-plus of card customers boasting FICO scores above 660. That conservative posture has helped the majors absorb the gradual uptick in losses without revisiting their reserve builds.

Beneath the loan books, the message regarding households was still constructive. Broadly speaking, earning calls highlighted employment and income trends remaining supporting. JPMorgan’s economists described the current labor backdrop as a softening of momentum rather than a crack in the floor.

Savings buffers have eroded from pandemic highs but they are not depleted, while average checking balances still sit above 2019 levels. Executives characterized consumer confidence as “cautious but functional.” Some households are trading down amid lingering inflation, but Bank of America noted that “income growth keeps pace with inflation,” limiting the strain on credit.

Potential weak spots to watch are more mechanical than structural. As rates drift lower, affluent customers could shift cash back into markets, causing deposit outflows at the margin. Card vintages originated in 2023-24 will hit their maturity window next year, giving investors a better read on whether losses are occurring like prior cycles. Auto residual values are stabilizing, but remain a swing factor for lenders. And while JPMorgan flagged a “low hiring, low firing” equilibrium, any deterioration in the labor market would quickly test the rosy view on consumer credit.

Summary: Third-quarter earnings results showed the US consumer remains steady, solvent, and still spending. As long as that holds, the rally in financials has fundamental backing.