The market’s reaction to earnings from Meta and Microsoft confirmed the tendency to separate companies into winners and losers from AI. While there’s a clear increase in skepticism toward big capital spending, markets are still prepared to reward ambition, especially from the more retail-friendly names.

Despite a solid set of earnings, Microsoft sagged as capital expenditure surprised. Yet Meta also announced an expansion of capital spending and shareholders loved it. Meta jumped more than 7% in post-market trading, while Microsoft slumped by almost the same amount.

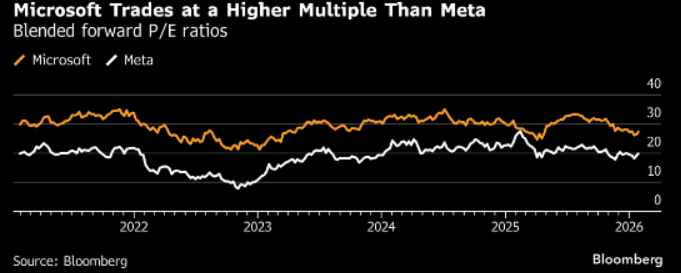

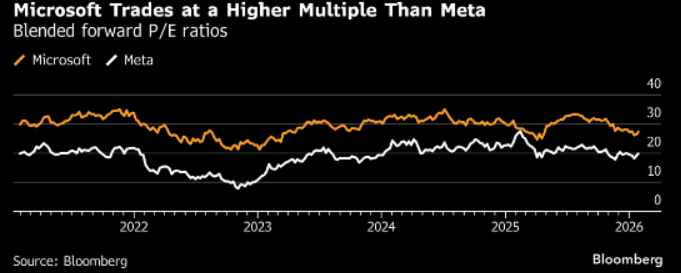

One explanation is that Microsoft struggles to provide clarity on how its AI spending feeds through into its business, and a lot of its future revenue seems to be dependent on a single customer, OpenAI, which is also a related party. Revenue in the Azure cloud business grows more slowly than AI spending, but the company is also selling AI compute across other areas of its business and not breaking it out in its reporting. Meta is also cheaper than Microsoft.

Moreover, Meta is also planning to spend much more than before, but its revenue outlook of as much as $56.5 billion this quarter, is higher than analysts had expected and would be at least 26% up on a year earlier. At the same time, the company is doubling down on its investment in AI.

“The highest-order priority for the company is investing our resources to position ourselves as a leader in AI,” Meta CFO Susan Li told the call. CEO Mark Zuckerberg appears to remain convinced that we’re all going to be wearing Meta’s AI glasses in a few years and is still pursuing vague opportunities in advanced AI superintelligence. But on the call, he also emphasized the very real role of AI in improving recommendations on Meta’s apps, translating videos and helping Meta’s own staff produce more with less.

Credit investors are acutely aware of the risk of increased supply to help fund the AI boom. Meta, which borrowed $30 billion in the bond market last year, did say it might issue again if it sees an opportunity to do so cheaply, though it expects to fund most of its AI spending from operating cash flow.

Microsoft passed $50 billion in sales for the first time. Revenue from its Azure cloud business grew 38% from a year earlier, while capex, excluding leases, was up 89%. Microsoft reported $625 billion of remaining performance obligations, up 110% year-over-year, but 45% of that is from OpenAI. RPOs from other customers rose 28% to about $350 billion. That’s the value of Microsoft’s future revenue from contracts that it has already signed.

Microsoft CFO Amy Hood guided for revenue growth of 15%-17% year-on-year, to between $80.65 billion and $81.75 billion in the current quarter. That’s only modestly above the analysts’ consensus of $80.4 billion. The cost of sales though will grow by 22% or 23% and operating expenses to rise 10% to 11%. That will result in a slight decline in operating margins.

Part of the difference in reception seems to lie in the relative communication skills of the CEOs -- Zuckerberg sets out a vision, however rose-tinted, whereas Microsoft’s Satya Nadella loves his jargon. The following is a quote from Nadella on the call:

“We are entering an age of macro delegation and micro steering across domains. Intelligence using multiple models is built into multiple form factors.”