Two days this week are likely to dictate the direction of the US stock market for the remainder of the year. On Wednesday and Thursday, five firms that account for about a quarter of the S&P 500 Index: Microsoft Corp., Alphabet Inc., Meta Platforms Inc., Amazon.com Inc. and Apple Inc. will report their earnings.

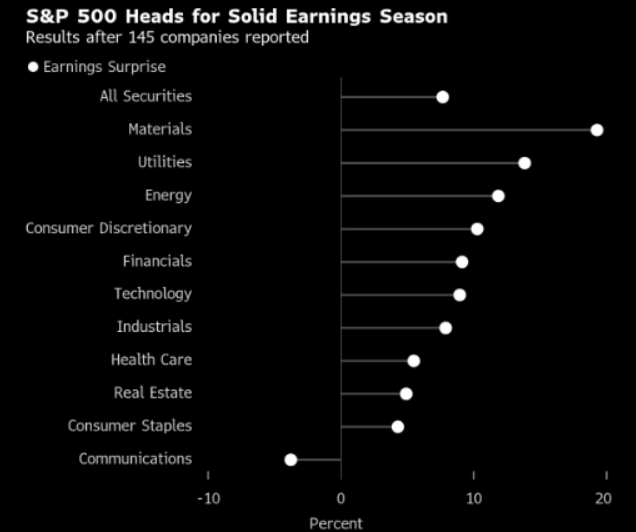

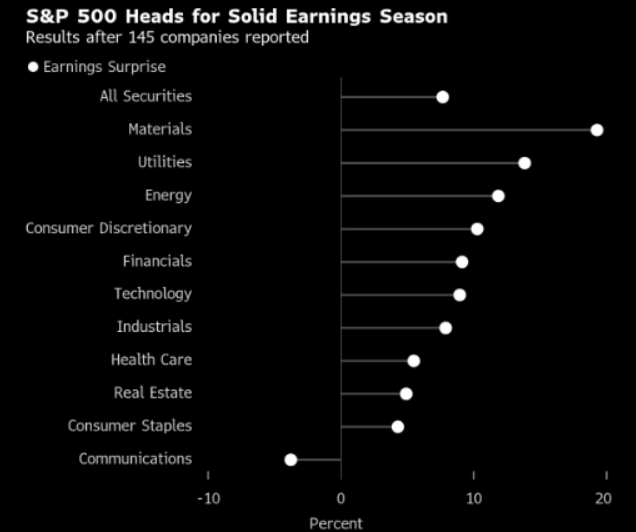

S&P 500 Earnings Surprises In Line With Recent Quarters

More than one-third of the S&P 500 has reported results and so far profit is beating expectations by about 7.7%, roughly in line with the last three quarters. Even energy stocks, losers in the second quarter earnings season, are doing well. The biggest disappointment has come from the communications sector.

The highlight of the earnings calendar last week was Tesla, which undershot expectations for earnings per share by 7%. Its stock fell, the only one of the Magnificent Seven to close the week lower (and the only one to report so far).

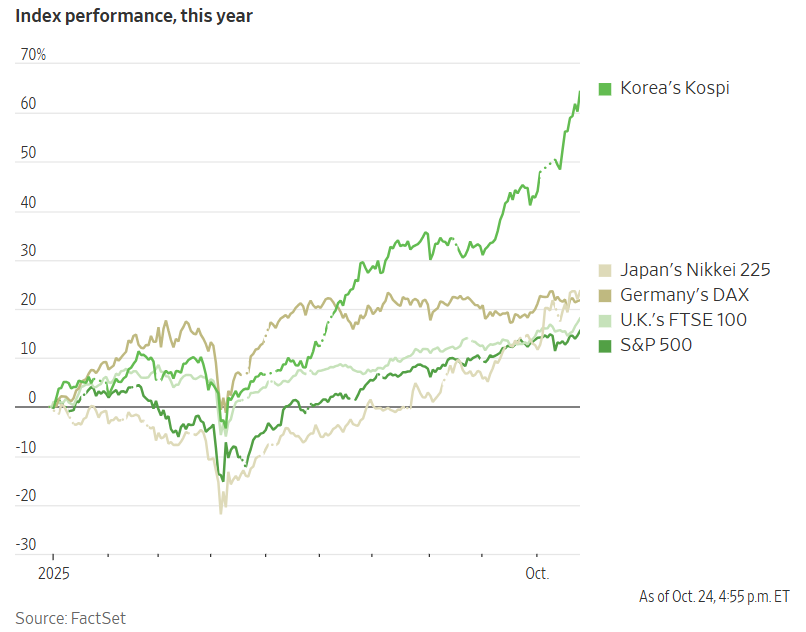

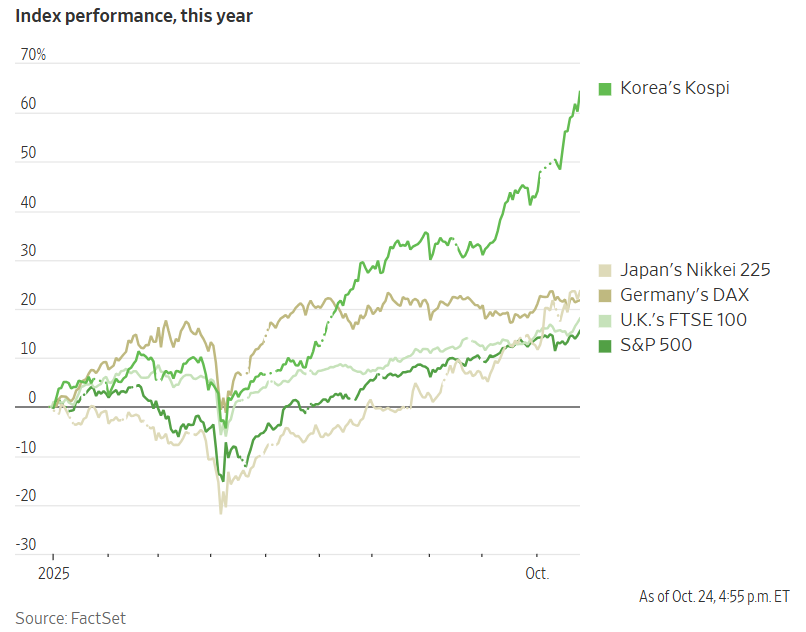

The MSCI All Country World ex USA Index, which tracks developed and emerging-market stocks, is up around 26% in 2025 on a U.S.-dollar basis. That bests the S&P 500, which is up 15% and heading toward its weakest annual performance since 2022. In contrast, South Korea’s Kospi is up 64%, Germany’s DAX has increased 22%, Japan’s Nikkei 225 has climbed 24% and the U.K.’s FTSE 100 has risen 18%.

The performances mark a sharp reversal from the past decade, when strong returns from U.S. stocks gave rise to a new investment thesis: “American exceptionalism,” the belief that strong economic growth, juicy profit margins and cutting-edge tech behemoths make America’s stock market the best place on earth for investors to park their cash.

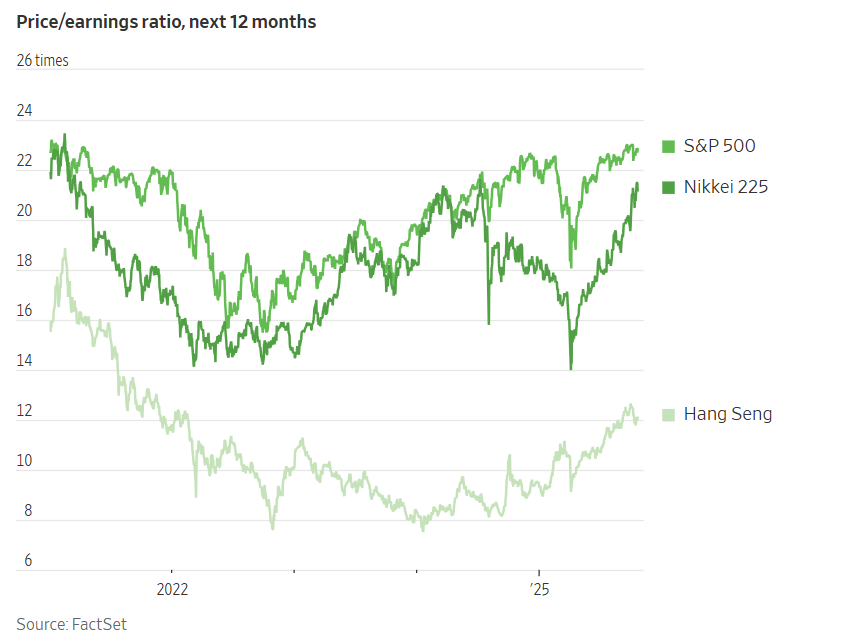

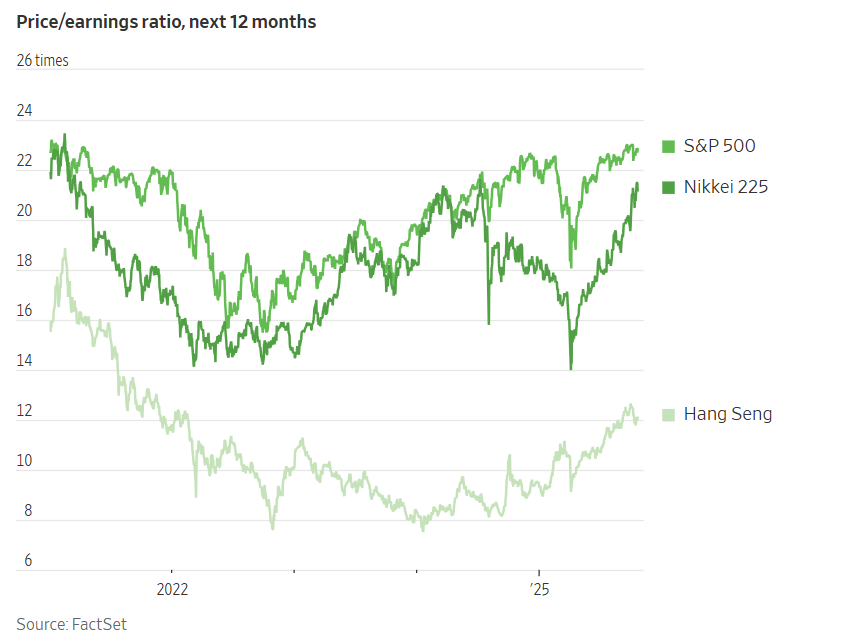

Stocks abroad look cheaper than pricey U.S. shares. Companies in the S&P 500 recently traded at 23 times projected earnings over the next 12 months, according to FactSet. In comparison, Japan’s Nikkei 225 recently traded at 21 times and Hong Kong’s Hang Seng multiple was about 12.

U.S. stocks still best their international counterparts over the long haul. The S&P 500 has climbed around 225% over the past decade, while the Nikkei 225 has gained about 158% and the FTSE 100 has added roughly 49%.

The International Monetary Fund said in its recent projections that U.S. economic growth is likely to slow to 1.9% this year, measured on a fourth quarter versus fourth quarter basis. That is above a 1.4% projection for the U.K., 0.2% for Japan and 0.3% for Germany.

We expect global growth to slow for the remainder of 2025, with a potential reacceleration in 2026. The US remains central to this narrative, balancing structural resilience with evolving risks. At the same time, we believe that the prospects for growth in Europe have improved and that the outlook for economic activity in China has stabilised. In the US, we expect growth to decelerate, while inflation may trend higher as the impact of trade policy continues to feed through to consumer and producer prices. While most companies have been slow to pass on tariff costs, anecdotal evidence suggests that this dynamic may shift, amplifying inflation and dampening consumer spending in early 2026. Still, ongoing fiscal support and potential sustained investment and productivity driven by AI capex may offset these headwinds, which could help growth momentum endure into next year.

This brings us to the reason why US remains ahead of the RoW in the AI race: AI capex. This week we will get to know what is the outlook on AI development from the 5 companies Microsoft, Alphabet, Meta, Amazon & Apple. The so-called Magnificent Seven, which includes the five companies reporting as well as Nvidia Corp. and Tesla Inc., accounts for nearly half of the S&P 500’s 15% advance this year.

To sustain the gains, however, investors are looking for assurances from the tech giants that the flow of tens of billions of dollars for computing infrastructure will continue and ultimately pay off down the road.

Microsoft, Alphabet, Amazon and Meta are projected to post a combined $360 billion in capital expenditures in their current fiscal years, much of it related to AI. That spending is expected to jump to nearly $420 billion next year.

So far, revenue growth from AI-related services is most evident in the cloud-computing businesses of Amazon, Microsoft and Alphabet, making those units a focal point of earnings reports. Meta has also said its AI investments are improving ad targeting and engagement in its social media units.

The spending, however, far outstrips the revenue those companies are generating from AI. But investors have given them the benefit of the doubt, bidding up Big Tech stocks this year on bets that the expenditures will allow them to dominate as the technology proliferates and new AI use cases emerge.

The heavy capital spending is threatening to eat away at one of the group’s most prized attributes: superior earnings growth. The Magnificent Seven is projected to deliver profit growth of 14% in the third quarter, down from 27% in the second quarter. That’s nearly twice the 8% expected profit growth for the broader S&P 500, but it also would be the slowest pace for the group since the first quarter of 2023.

This week’s nos from these 5 companies will decide if S&P 500 has more room to run and if it can cross the psychologically important 7000 level.