Credit default protection for Amazon and the US are running at about the same premium today. One seems mispriced, and based on debt alone, it’s likely Amazon.

CDS on Amazon jumped in recent weeks after the company revealed plans for more capex ahead. The price of default insurance rose to 38 bps, a near two-year high, amid the company’s plans to add $15 billion to its obligation load. Its total debt at the end of the third quarter was about $153 billion.

In contrast, default protection for five years on the US trades at just 35 bps. It has $38 trillion in debt outstanding, nearly 250 times what Amazon has.

Amazon at least has revenues and it’s near the top of the list of AI companies, the hottest business in years. The US, in contrast, has run a deficit since essentially forever.

For insurance on Amazon and US debt to trade essentially on par means their default risk is perceived to be the same and based on debt loads, the two are quite different.

But at the same time the huge blowout books for AI deals like Amazon’s today, or Meta’s from Oct. 31, may not necessarily mean investors love the AI theme, nor that bookrunners have great access to investors; rather, it tells you the price talk is cheap.

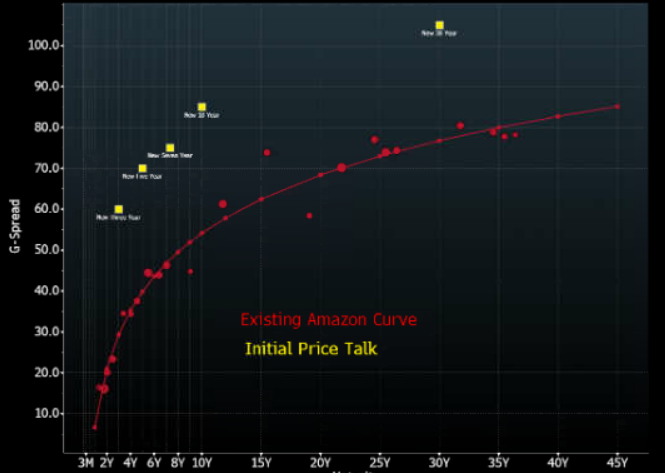

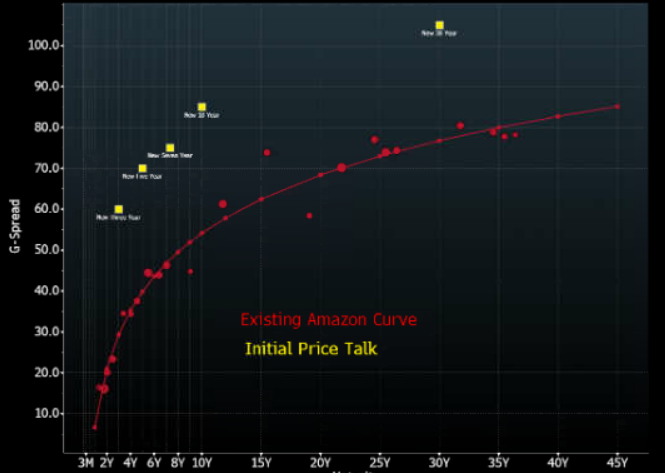

Here’s what the initial price guidance on the new $12 billion bonds looks like compared with Amazon’s existing curve. It looks very wide. That’s why there’s a book of $80 billion which is on sale now. The guidance is likely to get tightened.

This dynamic tends to be part of the customary dance of syndicate desks and investors. Bookrunners are motivated to set the initial guidance very wide. Investors place large orders, with the expectation that bookrunners will cut back. If the price guidance doesn’t tighten, the risk is that investors would question the quality of the book and may end up dumping the bonds in the secondary market. The same could happen if their orders don’t get cut back as much as expected.

As it stands though, the bonds on offer will get a huge book (currently at 80 BN USD) and outperform in the secondary market, the issuer will generate positive headlines, the investors will enjoy gains and the bookrunners can move up the league table and get an impressive tombstone. Everyone wins.

At its end-October bond sale, Meta initially marketed its 10-year bonds at 110 bps over Treasuries before pricing them at 78 bps. They’re now trading at 72 bps, which suggests the final pricing wasn’t far off the mark. The initial guidance was, and perhaps not by mistake.

How much Amazon pays will depend on how well the bookrunners can perform the dance in other words, how far the price talk can gettightened in without deflating the deal buzz. But it is certainly paying seeing by the size of bids it got today.