On 9th Nov, we had given a sell Reco on 10yr UST when yields were at 4.08. Our target was 4.30. Yest high was 4.297 so we close this reco for now.

https://macro-spectrum.com/trade-recommendation/sell-10yr-ust

What is next for 10yr UST yields?

In short term resistance is at 4.38 levels, the 61.8% retracement of the entire last 1 yr move from 4.65 to 3.95. Support on the downside is now at 4.20 levels which took some time for USTs to break out in the past few months.

UST yields new range is 4.20-4.40 till either rate expectations change materially or “Sell America” trade gathers force. We doubt the 2nd option though.

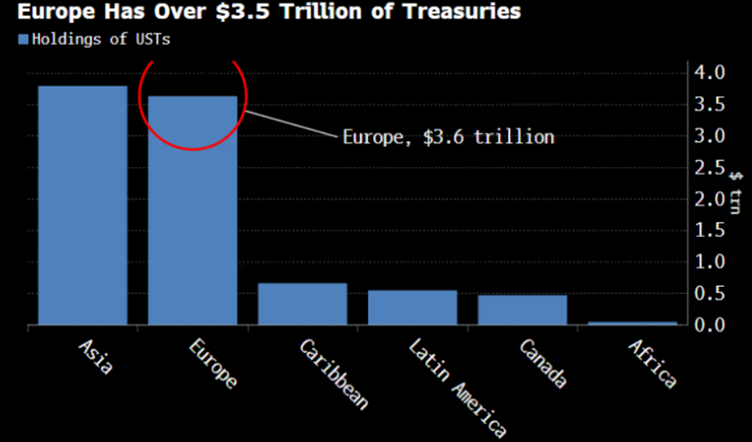

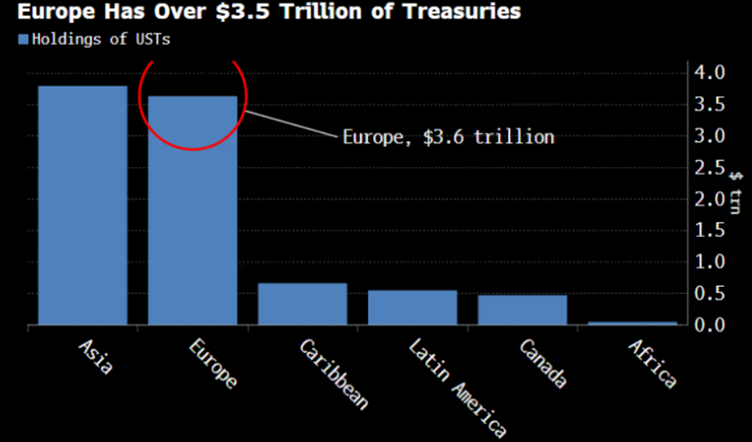

Any potential threat by Europe to sell its Treasuries in retaliation for President Donald Trump’s aim to annex Greenland is likely to be lack substance. A Danish pension firm’s announcement that it would sell its Treasury holdings has added sustenance to the notion that Europe more broadly will start selling its holdings en masse. But in our view, much of it is not possible in the larger scheme of things as we explain below.

First, Europe is the second largest holder of Treasuries, with more than $3.5 trillion, just shy of Asia’s total, but unlike in Asia, the majority of Treasuries in Europe are not held by central banks. It would take a corralling of private holders to force a coordinated sale, less likely than governments ordering their central banks to do so.

Second, the rise in US yields it would precipitate would be a problem for everyone. The global cost of funding would rise, and this would have a greater impact on Europe’s less-strong economy than the US’s.

Thirdly, who would buy Europe’s Treasuries at current prices? Emerging central banks mainly in Asia are the largest foreign holder of Treasuries, and they have stopped accumulating them. And in the US, positioning shows a reluctance to own USTs, at least at their current price. Europe would have to sell its holdings at a hefty discount.

Fourthly, what would Europe do with the proceeds? Buying European assets would mean pushing the euro higher, very problematic in a highly competitive world, perhaps at the onset of another trade war. And buying US stocks won’t seem attractive given the very action of Europe selling their Treasuries would be bad for risk markets. Moreover, the continent is already the largest foreign holder of US stocks, with almost $10 trillion of them.

Hence, Treasury Secretary Scott Bessent is correct to say the narrative of Europe selling its Treasuries is a false one.