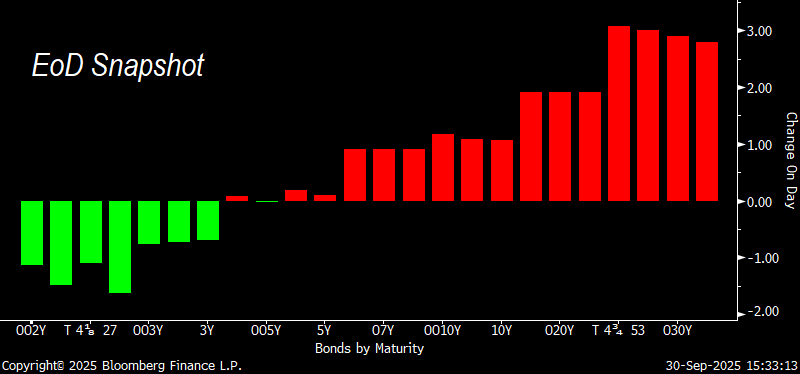

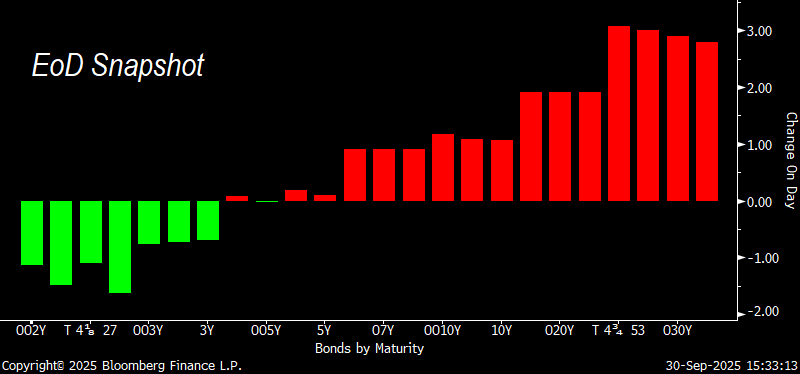

Main Market Highlights: USTs traded lower overnight, driven by the front end, but rallied into and after the pit open, reaching overnight highs. The range was -2 bp (2y) to +3 bps (30y); 2s10s was +2.6 bps; 5s30s was +2.7 bps.

1. Gains were met with further block selling (similar to yesterday’s TU and FV) in TU, FV and TY. USTs absorbed them well.

-Curve flattened early, supported by TU and FV block sales and mildly hawkish remarks from Fed’s Collins (modestly restrictive policy stance as appropriate, not out of the woods on inflation yet).

2. Post-mixed data (strong JOLTs, weak Consumer Confidence), the curve bottomed mid-morning, then steepened into the close, with 2s10s and 5s30s rising 3–4 bps from their data-driven lows.

3. Long-end underperformance drove TY to WN to new daily lows in the afternoon; TU held mid-range, while FV retested its morning low.

All told, it was a surprisingly quiet month/quarter end only for USTs but generally across assets given the price action.

SOFR swap spreads retraced some of recent Bowman-induced widening. 10y spread narrows back down to -49.375bps after hitting -48.375bps post Bowman peak.

SOFR: Reds and greens outperform as strip closes up to +3.5 ticks firmer; Peak contracts lifted back above 96.9.

otherwise.

What’s Priced? A little over 40bps priced for the Oct-Dec meetings & just over 60 bps for CY26.

Looking ahead: Active day for data Wednesday with ADP (Sep) ahead of Mfg PMI (Sep F), ISM Mfg (Sep), and Construction Spending (Aug). For speakers, just Barkin midday at UNC Wilmington Economic Outlook Conference.

What we find interesting:

Time to put Long 10yr UST against Short 10yr German Bunds:

Betting markets currently reflect a 73% chance of a US government shutdown on Wednesday. Trump administration is likely to use a shutdown to permanently lay off sectors of government workers that they deem unnecessary, whilst blaming the Democrats for the situation, creating more permanence to previously short lived GDP drawdowns, and creating increased pressure on October's employment report (which in our view already has a very good chance of being negative from the 150,000 government workers who were laid off in under deferred-resignations earlier this year but were paid until September). There are no debt limit issues involved around this shutdown. Hence both are +ve for 10yr UST yields. Also, there are no UST auctions this week, whilst we do have a €5bln 10y DBR auction on Wednesday.

On the German side, the macro arguments around increased government spending (and plenty of fiscal headroom to go much further, if necessary, particularly on defence, with the change effect on supply being significant), certainly exist. Also, the amount of selling because of Dutch pension reforms that is about to hit the market (both in terms of the size, €125bln of bonds to be sold across DBR, OAT and DSL lines, with an average duration of around 20 years = approx 250mln per bp and approx 500mln per bp to be paid around 30y € swaps), is not reflected in the price of outright yields currently. These flows are outright, and as the actual paying / selling starts, participants being taken out of the short 30y leg, will be selling/paying 10 years. This is likely to translate to higher bund yields as reality hits over the coming weeks / months.

Currently the spread is at 144 bps which we see going back to recent lows of 130 bps in the next fortnight.