Several money managers and strategists are betting that the Federal Reserve's shift back to cutting interest rates will further add fuel to the biggest emerging-market bond rally in years. EM LCY debt performance has reached a fresh YTD high amid lower UST yields and a weak USD.

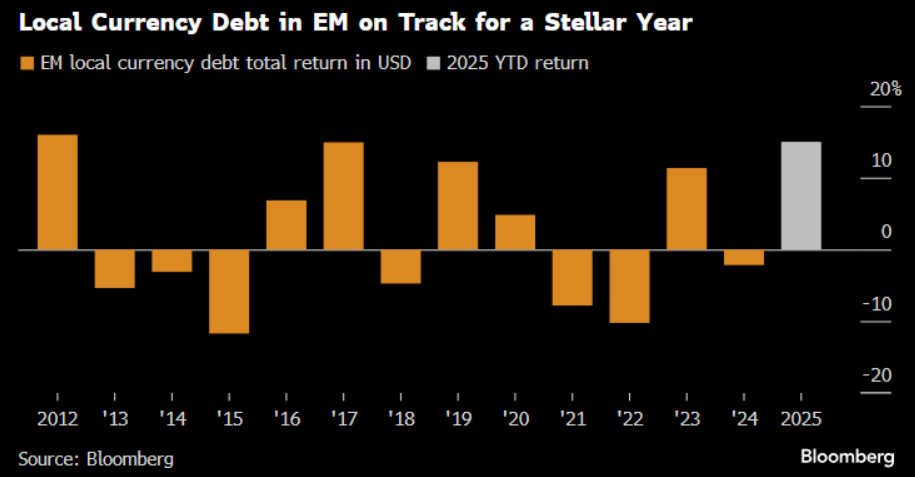

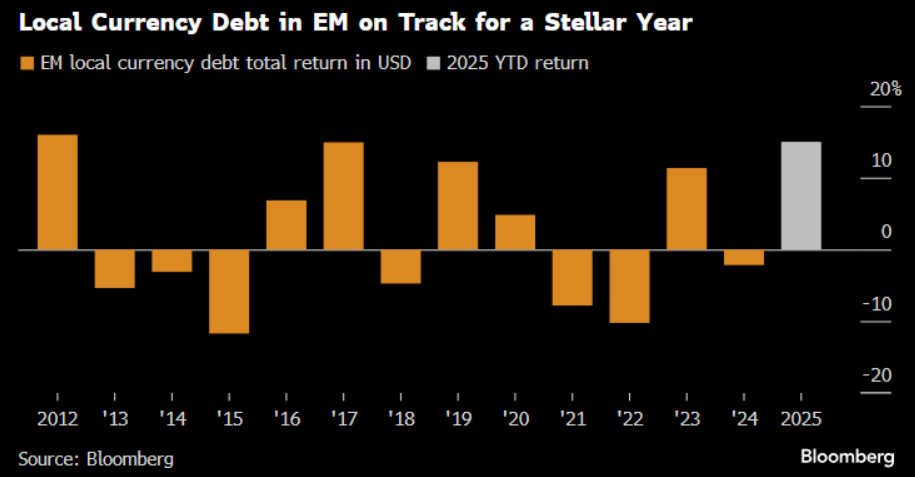

EM LCY debt returns touched a fresh YTD high of +15% (on an unhedged basis) in September after a somewhat lacklustre start in Q3.

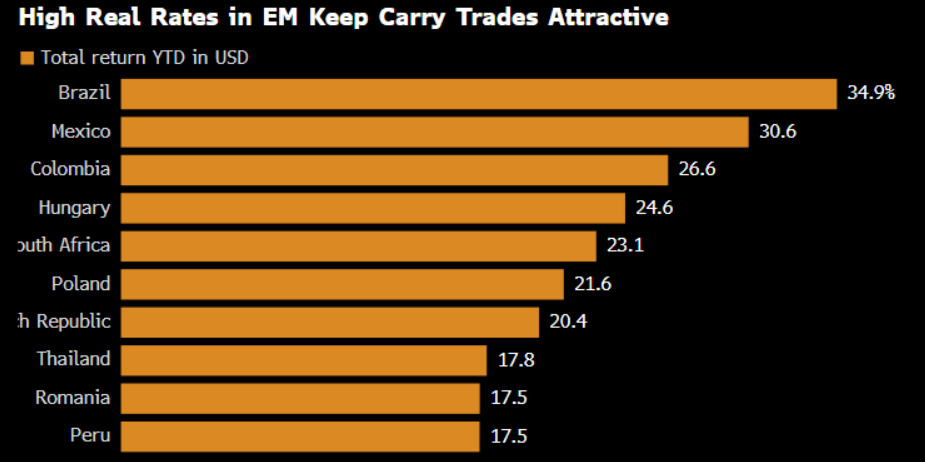

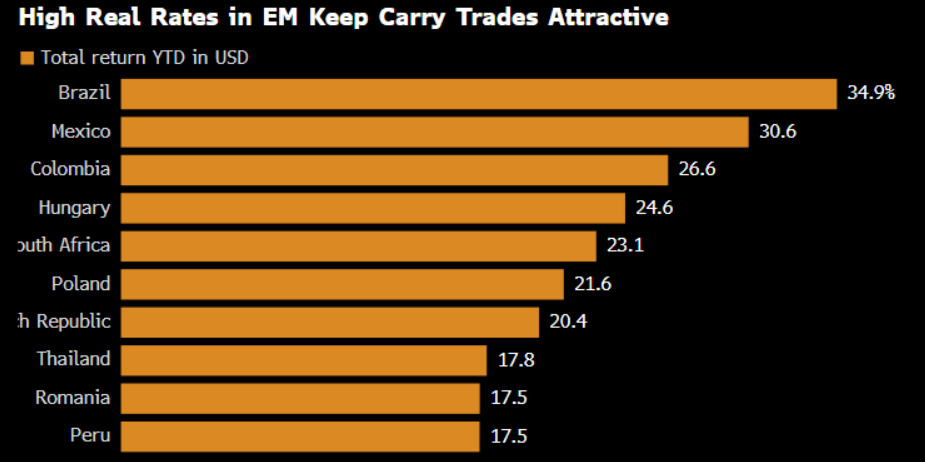

This performance – the best in the first eight months of any year since 2017 – was supported by lower UST yields and a weak USD. The rallies across emerging markets were fanned by Trump’s erratic tariff rollouts, which during the first half of the year sent the dollar tumbling by the most since the early 1970s. At the same time, interest rates have remained significantly higher in developing nations, where many central banks were more hesitant to ease monetary policy due to concerns about inflation.

The combination has driven emerging-market government debt to outperform most fixed income investments globally. The 15% jump is more than twice that of US corporate junk bonds, and compares with 5.4% gains in the Bloomberg US Treasury Index. The rally has been led by Brazil, Mexico, Colombia, Hungary and South Africa — all of which gained at least 23% this year.

Recent weak US labour-market data and consequent market expectations of Fed rate cuts are likely to support near-term performance of the asset class. The Fed's easing is expected to continue to weigh on the dollar, which boosts the returns of bonds backed by appreciating currencies and may kindle carry trades that involve borrowing in the US.

Key risk for continued performance is from Fed undershooting market expectations of US rate cuts.

The returns have continued to draw cash into emerging-market funds. Those focused on debt lured about $300 million in the week ended Sept. 17 — the 22nd consecutive week of inflows, EPFR data compiled by BofA show. Year-to-date net inflows stand at $45 billion.

The spread of the EM LCY index average yield over 10Y UST yield is 200bps (GBI-EM-GD estimated average yield: 6.1%), below the past-10-year average of 350bps.

We have been highlighting for the past few months that US gdp growth is a jobless growth fueled by AI capex. Sooner than later, the delicate balance between low hiring & low firing will break as corporates start to dehoard labor when their margins start seeing pressure due to lower consumer demand as they pass on tariff hikes. Hence our view is that we might see a front loaded rate cut cycle in US of 25bps each in next 4 meetings. This bodes well for further strong EM LCY debt performance.

We in fact see “no alternative” for the rest of the year that would rival EM carry trades — which involve borrowing in countries where interest rates are low and investing the money in those dangling higher returns. Developing-nation policymakers may follow Fed’s rate cutting cycle, giving the bonds another boost. Inflation-adjusted yields in places like South Africa and Colombia will likely also keep drawing in cash from carry trades.

On an average, emerging-market debt has returned between 6-8% after the onset of Fed rate cuts.