The bid in Treasuries has staying power in the days ahead with concerns around credit quality at US regional banks surfacing again.

Yields fell across the curve with the 2-year reaching a post-2022 nadir (chart below) and 10s the lowest in over a year.

The moves were sparked by a surge in risk aversion that sent Zions Bancorp down 13% and Western Alliance Bancorp off by 11% after the companies said they were the victims of fraud on loans to funds that invest in distressed commercial mortgages.

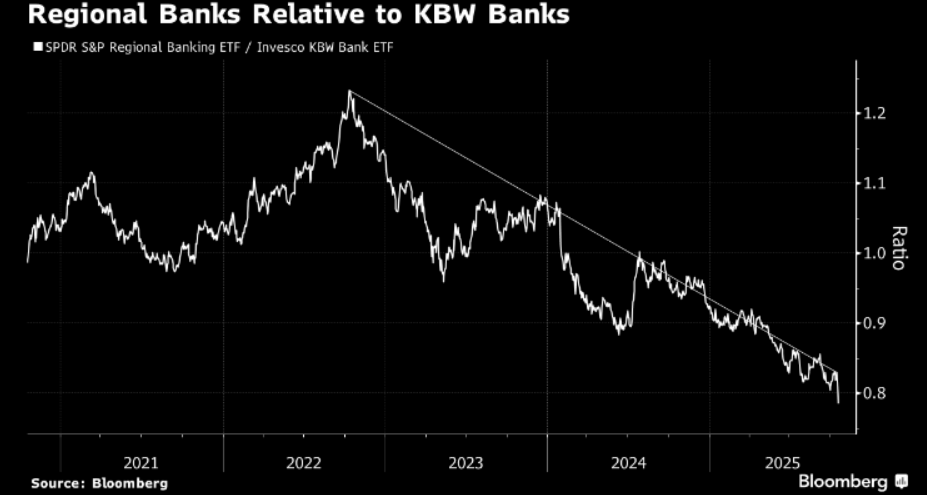

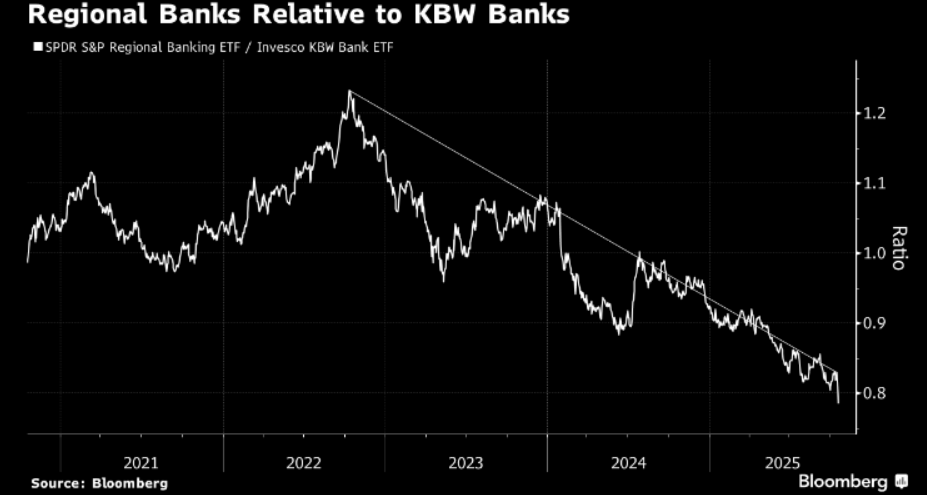

The steep selloff in regional banks pushed the SPDR S&P Regional Banking ETF to an all-time low relative to the Invesco KBW Bank ETF, which tracks the largest US lenders. The SPDR Regional Banking ETF has been in a downtrend relative to the KBW Bank ETF since 2022 and suggests the underperformance of regional banks will continue. The top holdings in the KBW Bank ETF include: Morgan Stanley, Wells Fargo, Goldman Sachs and Bank of America. The top holdings in the SPDR S&P Regional Banking ETF include: Cadence, Citizens Financial, Columbia Banking and ValleyNational.

The situation brings back memories of the mini-banking crisis of March 2023, when yields fell in response. Silicon Valley Bank collapsed on Friday, March 10 and Signature Bank two days later. On March 14, Fed officials put the debate on the health of the banking sector to rest, saying the system is on solid footing and giving Treasuries the green light for higher yields.

Bonds won’t get that chance this time around, with Fed officials headed into their quiet period ahead of the Oct. 29 FOMC meeting. Musalem from the St. Louis Fed is slated to speak Friday before the blackout starts, meaning there’s still a chance to get some sense of policymakers’ thinking. But investors would prefer to hear it from Governor Michele Bowman, the Vice-Chair for Supervision.

Even if the credit events are isolated, banks taking losses from bad loans are making headlines more often in the past two months. After the bankruptcy of sub-prime auto lender Tricolor Holdings last month, JPMorgan wrote down $170 million and Fifth Third Bancorp wrote down as much as $200 million.

While regional bank cockroaches likely won’t be enough to sustain risk off trading, the market will want assurances from the Fed’s vantage point before moving past it. What’s adding to the downtick in UST yields are also the persistence of the government shutdown and China trade tensions.

Summary: Jamie Dimon was right about cockroaches in JP Morgan’s post earnings call this week when he said “And I probably shouldn't say this, but when you see one cockroach, there are probably more… Everyone should be forewarned on this”. Friday we will get to know if there are more cockroaches when earnings of 11 regional US banks come. Till then risk assets sell off might support further drop in 10yr USTs. We are eventually looking for 3.85 on 10yr UST and 3.35 on 30yr UST. This has been our view since past few months as written on 4th Oct in our premium opinion piece as below when 10yr UST was trading at 4.12 levels and 30yr UST was trading at 3.75 levels.

https://macro-spectrum.com/opinion/is-the-us-long-end-undervalued