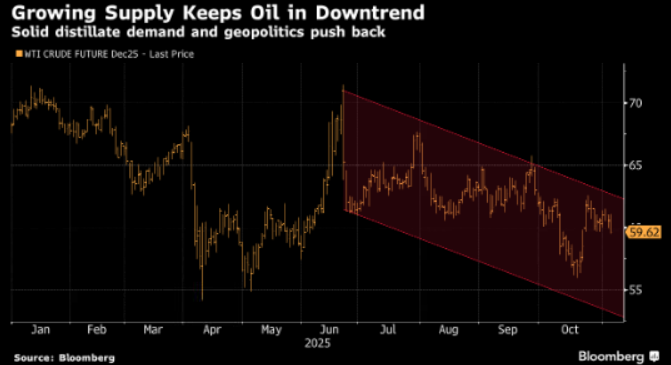

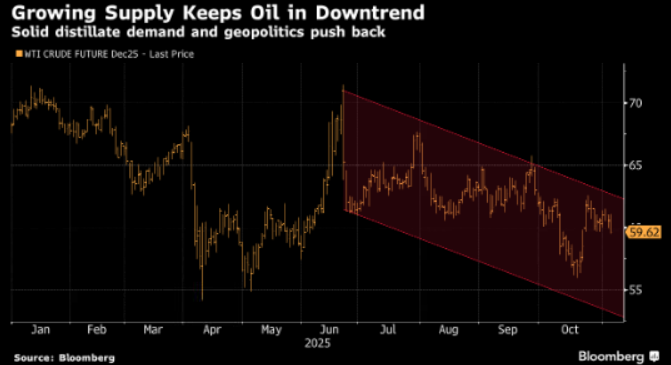

Oil is lower Wednesday to around 63.5 levels on Brent, with prices moving to the bottom of their recent range as rising supply battles distillate demand and geopolitical risks.

The latest weekly inventory data, while often volatile, sheds further light on the dynamics at play in oil markets. US crude stocks rose by the most since July as imports rebounded and refinery runs stayed subdued due to seasonal maintenance. At the same time, Kpler’s tanker tracking showed exports were lower than the EIA’s estimate, meaning fewer barrels actually left the country. Put together: more coming in, fewer going out, and lower refinery runs all magnified the crude stock build.

Distillate demand continues to hold up, keeping refinery profit margins firm with heating oil and diesel at their strongest levels since early 2024 and gasoline at its best levels since September. This supports modest backwardation and counters some of those supply glut fears. However, despite draws for products inventory and firm margins, the EIA implied gasoline demand is near a five-year seasonal low making the tightness look more technical on refinery mix shifts and outages rather than a true demand surge.

Geo politics add uncertainty but there’s no sustainable trend. Russia’s flows have been disrupted in the near term, pushing more crude into floating storage and denting revenues, yet traders expect barrels to be re-routed rather than destroyed.

US military assets around Venezuela suggest a strike remains very possible there. Venezuela mostly sells a thicker, higher-sulfur kind of crude that many US Gulf Coast refineries are built to run. If those barrels get disrupted, swapping in lighter crude doesn’t work perfectly, and finding similar heavy oil takes time. That mismatch usually lifts prices, especially for near-term deliveries and for diesel.

With President Trump feeling increased pressure to keep inflation down following Tuesday’s election results, rising oil prices would be especial unwelcome, indicating any strikes will spare oil infrastructure. Further, OPEC+ has some spare capacity especially Saudi and Iraq heavy barrels and Washington can release sour crude from the SPR. If those arrive fast, the near-term squeeze would be manageable.

Finally, the growing level of supply will be a headwind to any rallies. While OPEC+ has stabilized output, non-OPEC barrels led by US production at a fresh record keep grinding higher. Further, Guyana is switching on new offshore projects, Brazil is pumping more from big deep-water fields, and Canada’s new pipeline is moving more oil to market together adding a steady stream of non-OPEC supply into 2026.

Summary: Crude remains a sell on rise market for now.