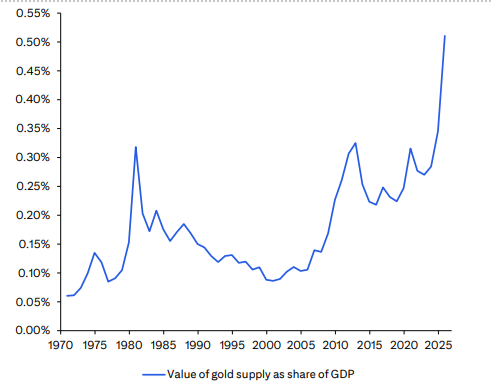

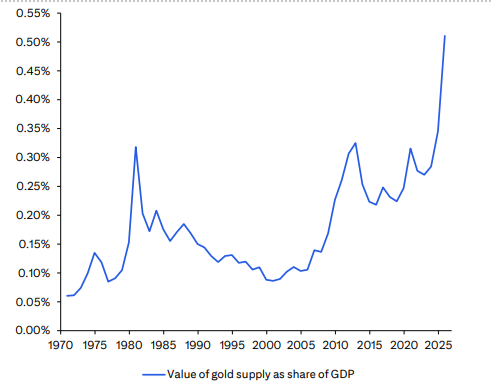

Gold prices continue their golden run, with today another blockbuster day. Today up by almost 2%, Gold is now trading at 3747 levels. Even if we look at inflation adjusted Gold prices, we are far higher than even the 1980’s levels. (see chart below)

Chart 1: US CPI adjusted Gold prices

We think the rally in gold prices has been powered by structural forces related to central banks’ divestment from fiat monies, not just the dollar. Years of QE and fiscal imprudence in almost all of the reserve currency issuing countries have played at least as important a role in pushing/repelling wealth out of fiat monies and sovereign bonds into alternative vehicles. For the same reason, Bitcoin Gold have strong correlation.

Calling a top in gold prices is tantamount to calling an end to this divestment from fiat monies. The world may be in early stages of such divestment and that gold prices could continue to rise, due to a lack of alternative ‘currencies’; gold has always been a currency. In a hypothetical scenario, starting from the current position where gold is already the largest reserve asset, second only to the dollar, if the world’s central banks raise their gold holdings as a share of total reserves to match that of the dollar, gold prices could reach USD8,500 an ounce, all else equal.

There are other issues at play too which are supporting Gold prices such as continued uncertainty around tariffs, expectations of monetary easing, growing US debt concerns, and concerns over Fed independence. Gold’s safe-haven appeal continues to grow.

We expect both the cyclical drivers (e.g., continued weakening in US labor market, tariff-driven US and global growth concerns) and the structural drivers (e.g., concerns on US debt, US$ status and Fed independence, elevated geopolitical risks) to remain bullish for gold in the near term.

Unsurprisingly, gold volume traded has picked up on a global basis, but two areas stand out. First, gold ETP buying accelerated at its fastest pace since February over the past week, and second, volume traded on the Shanghai Gold Exchange accelerated at a faster pace than other key regions.

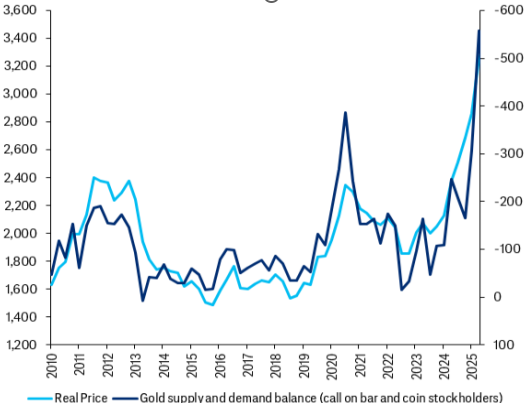

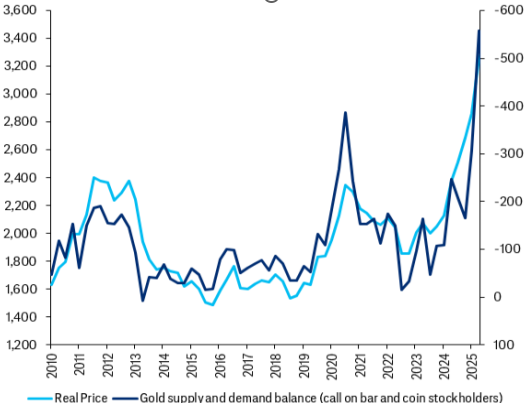

The call on gold stockholders is likely extremely high at present – we estimate that stockholders need to sell ~1% of their total holdings per quarter to clear the market – and the marginal stockholder is only willing to sell at incrementally higher prices. This year’s increase in the ‘call on stockholders’ has been driven by a massive increase in investment demand, rather than central bank or jewellery demand, both of which have remained resilient in value terms but have fallen in volume terms.

The physical gold market is estimated to be running a large deficit (or more accurately, a high call on stockholders to sell) at present. With stockholders not wanting to sell for the same reasons that investors are willing to buy at higher and higher prices (i.e., the gold market story is intact) prices can simply keep rising until the new buyers stop wanting to buy and the stockholders are more willing to sell. The key trigger for this will be a turn (higher) in US growth sentiment which we believe is a Q1-Q2 CY26 story.

We estimate that the physical gold market is running an extremely large deficit at present (requiring stockholders to sell 1% of their stocks to fill the deficit).

To end, the chart below shows that spending on gold as a share of GDP is almost double what it was in 1980 during the 2nd oil shock and the highest in over 50 years.