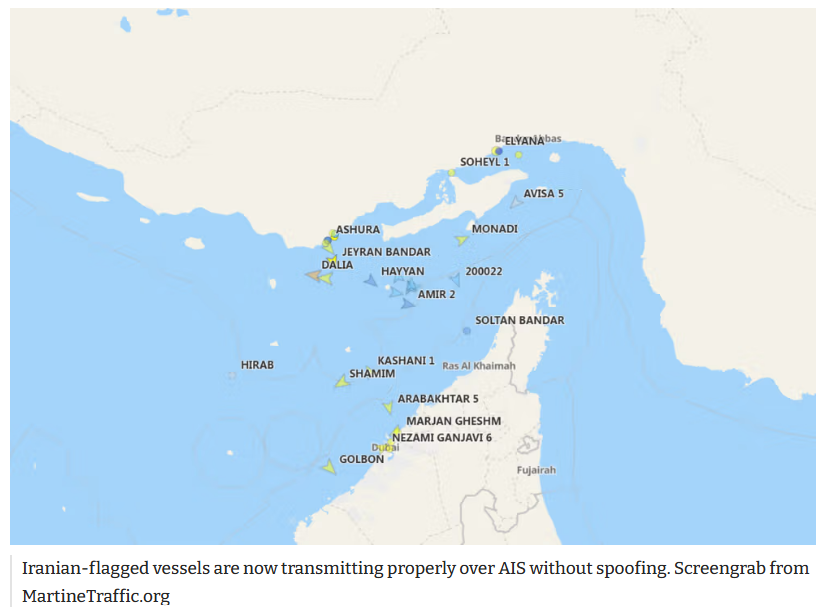

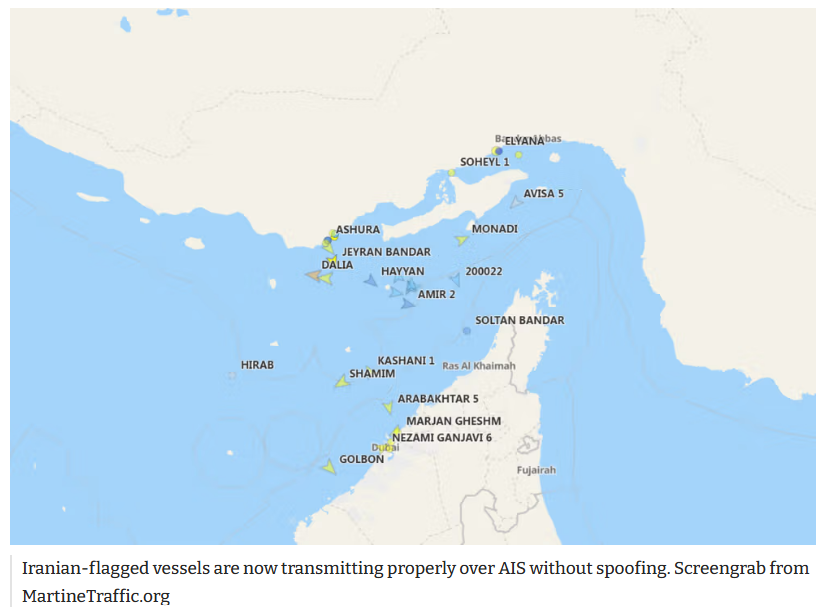

For the first time in more than seven years, Iranian-flagged oil tankers are broadcasting their location accurately and without spoofing raising eyebrows among longtime watchers of Tehran’s sanctions-busting efforts.

The change was first noted by vessel-tracking firm TankerTrackers on Monday and has since been confirmed by several providers of AIS (Automatic Identification System) data.

Since the United States reimposed oil sanctions on Iran in 2018, Tehran’s tankers have relied on tactics to evade detection, including switching off transponders or transmitting false coordinates.

The decision might be tied to the return of recent UN sanctions on 28th Sep either as a deterrent against seizures or as an attempt to legitimise Iran’s maritime activity.

The deterrence theory implies Tehran is signalling that any seizure could prompt retaliation; the legitimacy theory suggests it wants to show its tankers are carrying oil, not weapons or nuclear material.

According to Kpler, more than 80 percent of tankers carrying Iranian crude transmitted AIS data within the past 48 hours, although the so-called ghost fleet operating under other flags may still be off radar.

Under UN International Maritime Organization (IMO) rules, AIS spoofing and manipulation are violations that can trigger serious consequences if enforced. Iran may perceive that the UN is likely to take stronger enforcement action against violations of these IMO requirements.

Iran has long used ageing, often uninsured ships operating under various flags for ship-to-ship transfers before cargoes reach Chinese ports with their origin obscured.

The renewed 28th Sep UN sanctions give other countries stronger legal grounds to inspect or seize Iranian ships, especially those without insurance.

US has warned last week that ships disabling their AIS could face sanctions. As a result, Chinese ports and insurers are now insisting vessels keep their tracking systems on.

About 82 percent of Iranian oil cargoes are transferred at least twice before reaching their destination, and it now takes an average of 10 weeks to reach China, instead of 3 weeks under normal conditions.

The daily charter rate for a very large crude carrier (VLCC) is around $100,000, while vessels in the “ghost fleet” charge several times more. The extended voyages can erase up to 15 percent of a cargo’s value.

Tehran has recently increased its oil discounts to Chinese refiners by about 30 percent. Iranian crude is now sold to China at US$8–10 per barrel below comparable Middle Eastern grades, while Tehran bears extra costs for rebranding, forged documents and intermediaries to mask the source. Tehran may have concluded that elaborate sanctions-evasion tactics are eroding too much of its oil revenue. It is also possible that Iranian authorities now believe China will continue purchasing Iranian oil, allowing them to deliver shipments more openly.

Summary: It seems that post the new set of UN sanctions on 28th Sep, Iran has decided to follow the IMO rules in spirit & letter. Non compliance adds to costs with out any benefits. Also with US China trade war intensifying, Iran does not need to hide it’s exports to China. Crude tracking companies might now be able to more accurately predict demand supply surplus as well as inventories levels. This development also implies less geopolitical risk premium in oil pricing leading to further fall in prices.

To us, Crude oil’s demand outlook is weak enough to mean prices are likely to keep sliding despite Trump comments today that Indian Prime Minister Narendra Modi vowed to halt purchases of oil from Russia.

The supply/demand dynamics for oil remain grim. The IEA just boosted its forecast by 18% for the crude glut in 2026 estimating world supply will exceed demand by almost 4 million barrels a day. The outlook gets darker still when you consider that major commodity traders Trafigura and Vitol both say they aren’t bullish on Chinese oil demand. Goldman Sachs meantime expects significant inventory builds in OECD countries. We see Brent headed below 60 and staying below 60 by end CY25. We have been bearish on Brent since it was at 80+ levels even during the brief Israel Iran conflict. Some of our premium opinion pieces with the same view are as follows:

5th Oct

https://macro-spectrum.com/opinion/to-russia-with-love

6th July

https://macro-spectrum.com/opinion/the-return-of-saudi-barrels

15th June

https://macro-spectrum.com/opinion/pricing-oils-geo-political-risk-premium

3rd May

https://macro-spectrum.com/opinion/crude-might-fall-some-more

To Subscribe to our premium plans please visit:

https://macro-spectrum.com/plans