DXY fall of 10% since early Jan had led to market speculation that US exceptionalism is over now.

But as we move in to 2nd half of CY25 and into CY26 there is a compelling case for US exceptionalism to return.

US has following factors which still calls for exceptionalism:

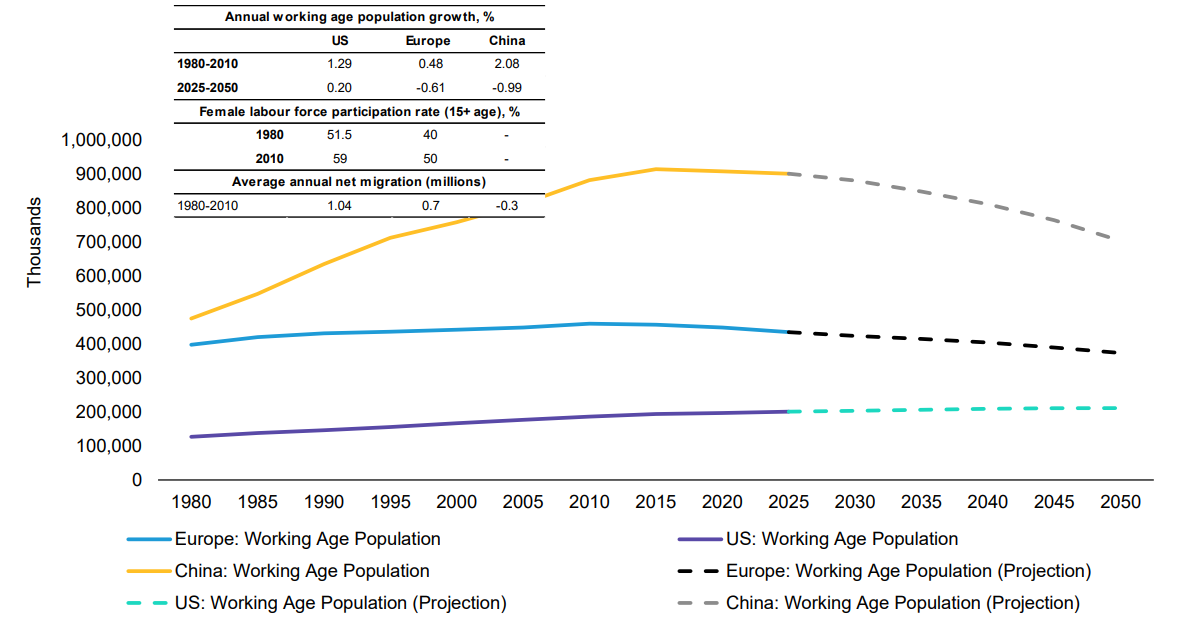

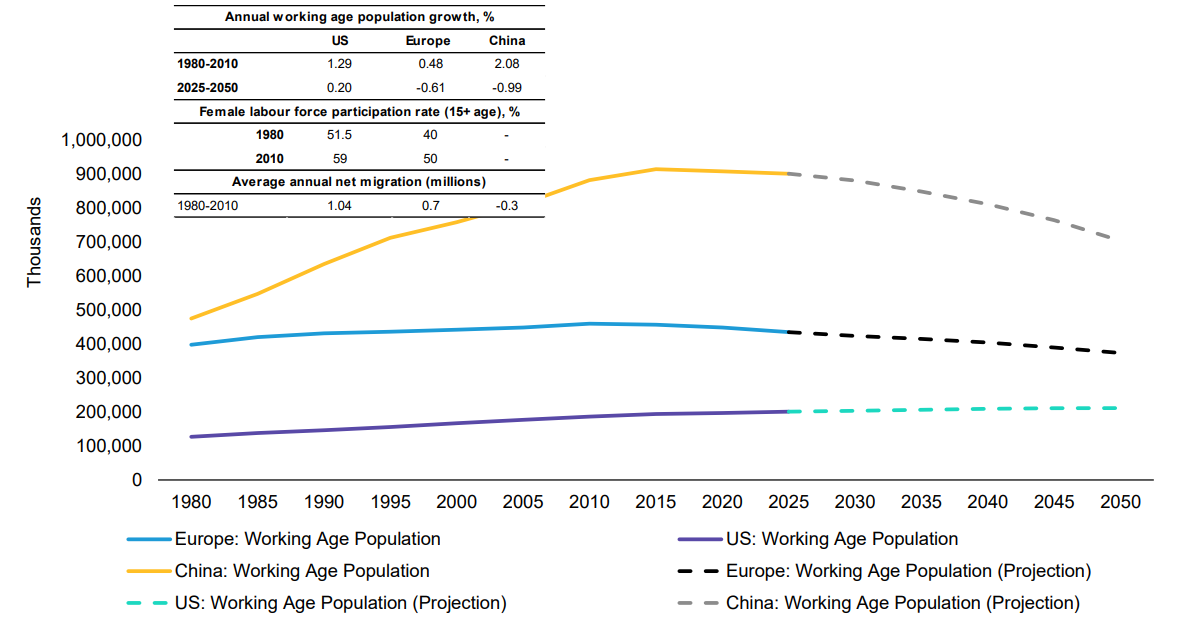

1. Relatively more favourable demographics

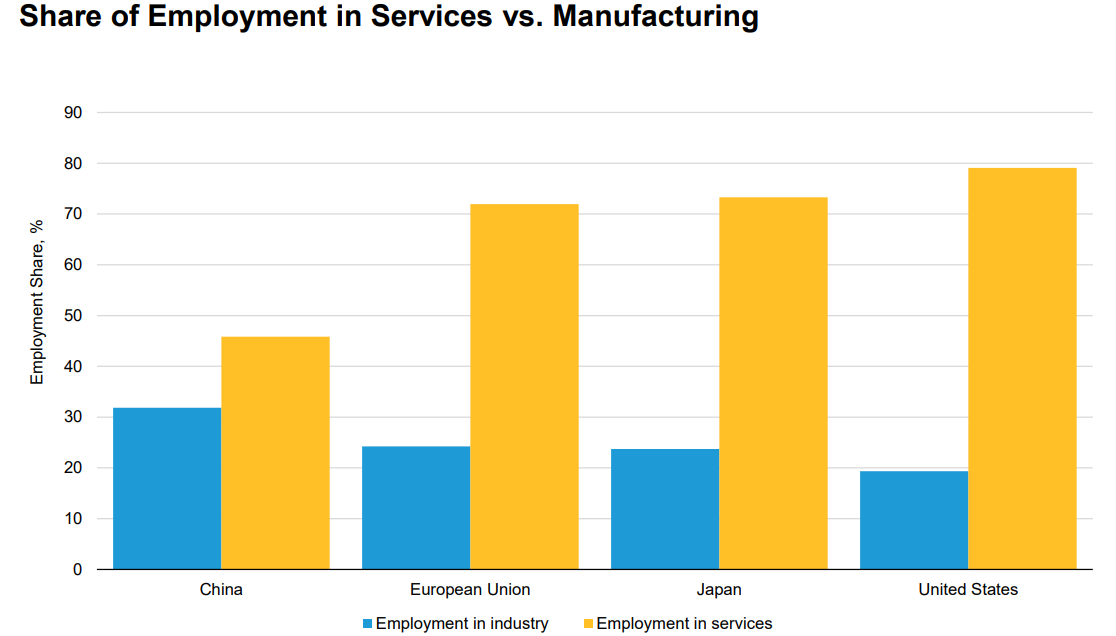

2. Structurally higher and more persistent corporate profitability

3. Geographic security of supply chains

4. Scale of home market

5. (for shareholders) corporate-friendly policies, low tax rates, lax anti trust

The following factors make the case for US exceptionalism weaker:

1. Standing back from international institutions reduces influence of US?

2. Weaponisation of dollar and capricious policymaking hastening hunt for USD alternatives

3. Undermining of US universities: risk of brain drain

4. Rapid undermining of US soft power

5. Energy transition elsewhere could remove US energy supply advantage

6. Negative shocks to size of working age population?

We look at US demographics vs China & Eurozone and find it better placed on many parameters.

US is the hotbed for AI currently. We believe AI will add to US exceptionalism case over medium term.

We also believe Dollar will still remain the major trading FX for years to come:

1. Stablecoins could drive increased USD adoption near term.

2. No alternative to the dollar? China won’t make Renminbi convertible

3. Reach of USD is far greater than previous reserve currencies

4. Absolute US growth rate lower than past but still exceptional vs other economies

5. “Not enough” gold etc, even adding crypto. Asset-backed currency limitations.

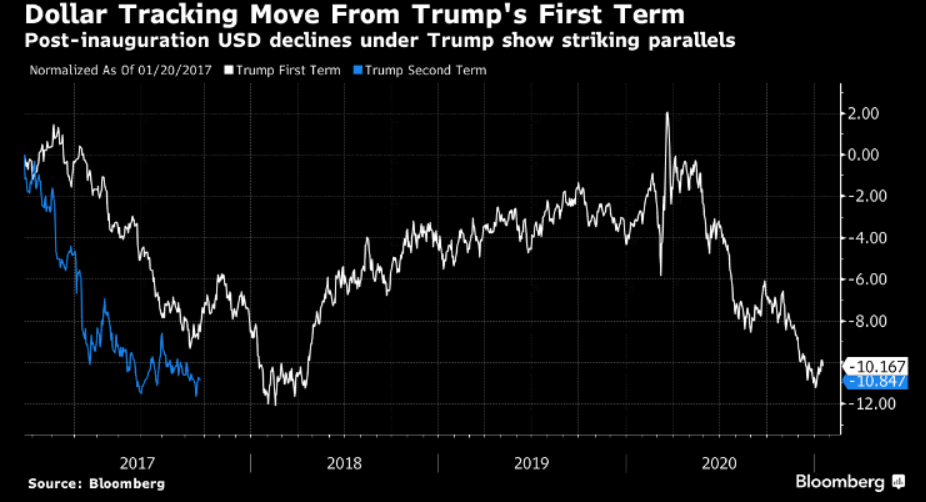

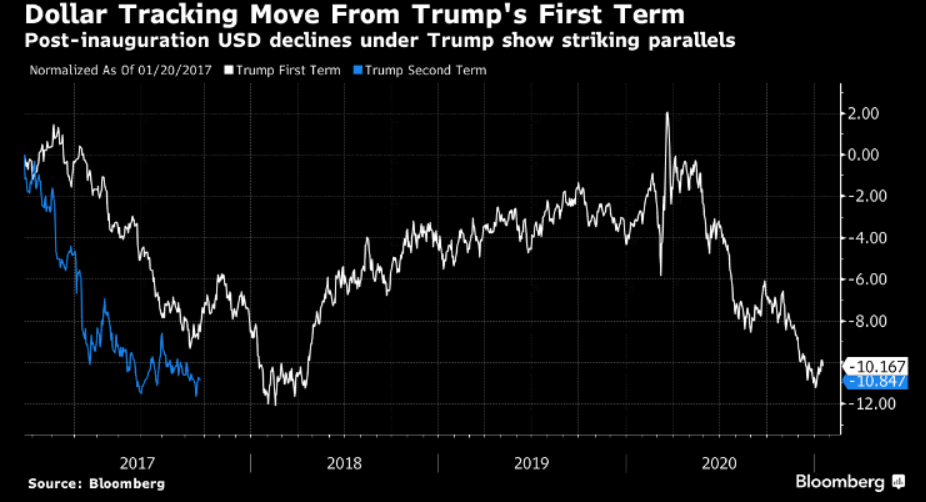

On a macro basis, the dollar is shifting from a rate-cut casualty to a superior relative growth story, echoing patterns from President Donald Trump’s first term and setting the stage for potential gains.

The passage of the Tax Cuts and Jobs Act in late 2017 offered a powerful boost to the US economy. With the passage of the “One Big Beautiful Bill,” fiscal tailwinds are expected to strengthen household balance sheets and underpin consumption into 2026, potentially creating another window where US growth shines relative to the rest of the world.

The parallels between Trump’s first and second terms are increasingly difficult to ignore, both in the policy mix and in market behavior. Normalized charts of the dollar following each inauguration show strikingly similar trajectories, reinforcing the idea that fiscal stimulus and relative US outperformance can set the stage for a stronger dollar.

On a interest rate differential basis, the dollar’s slide has largely been a terminal rate story, with pricing consolidating near 3% and offering some stability after a historic 1H decline.

Summary: US exceptionalism might face more structural tailwinds than cyclical headwinds. This view is a long-term view based on the caveat that US employment & economic data does not worsen significantly. Or that Trump does not take away the Fed’s credibility by trying to fire Fed Chair Powell before his term ends in May next year.