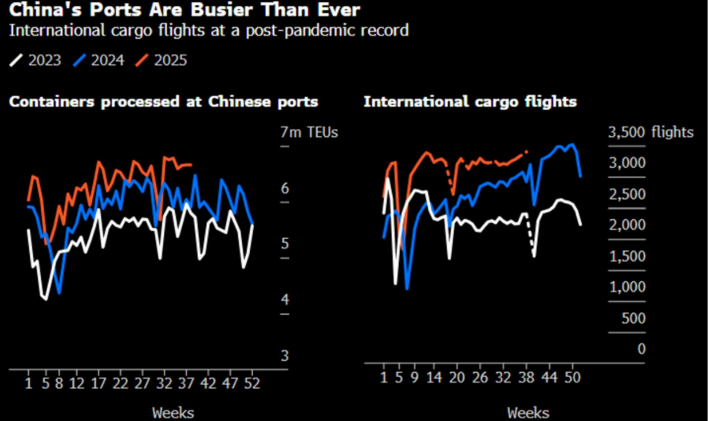

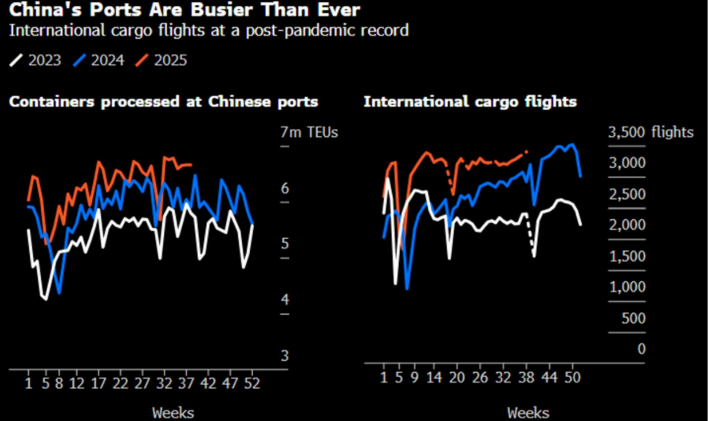

Trump’s tariff policies have unleashed Chinese export shock to the rest of the world. And proving it’s mettle, President Xi Jinping’s export engine has proved unstoppable during five months of sky-high US tariffs, sending China toward a record $1.2 trillion trade surplus. Chinese exporters are replacing US markets by ASEAN, Africa and EU markets.

Hence concerns are rising globally that China is engaging in dumping, selling goods in foreign markets at prices lower than their domestic cost to offload excess production, particularly in India and Europe. This practice, driven by factors like reduced Western demand and US tariffs, results in a flood of cheap Chinese goods, which can harm domestic industries in importing countries, leading to increased calls for antidumping duties and other trade barriers.

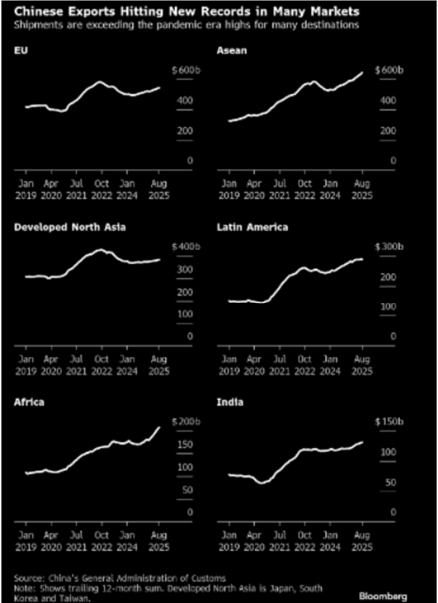

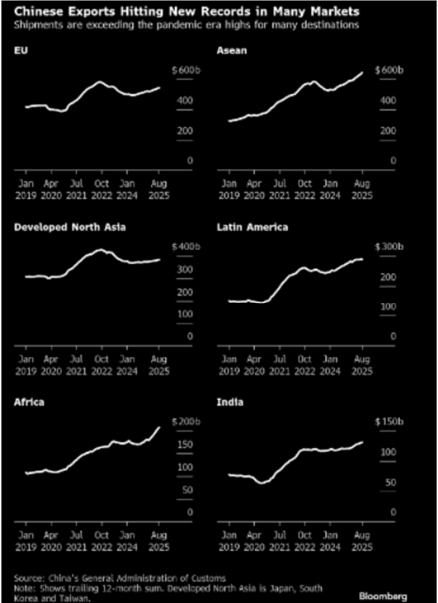

Since returning to office in January, Trump’s new barrage of tariffs on Chinese imports is beginning to reflect in trade data. Chinese exports to the US have fallen sharply in the first seven months of 2025, while China’s exports to Southeast Asian countries— particularly Vietnam—have risen.

Trump’s tariffs have taken a major toll on US-China trade in 2025, the August trade data from China Customs reveals. In the first eight months of the year, two-way trade dropped 14.4 percent from the same period in 2024 in US dollar terms, with exports falling at an even faster 15.5 percent rate. The US has also fallen to third place among China’s top trade partners, behind ASEAN and the EU. However, it remained China’s trade partner on a single-country basis.

The US’s shrinking share of China’s overall foreign trade – which increased 2.5 percent year-on-year to reach US$4.1 trillion between January and August – was offset by strong exports to emerging markets, in particular ASEAN, India, and Africa, as well as the EU. Total trade with ASEAN grew 8.6 percent year-on-year in the first eight months, with Vietnam, Thailand, and Indonesia all recording double digit growth. Chinese exports to Africa soared 24.5 percent year-on-year in the first eight months, while overall two-way trade was up 15.9 percent.

China is in a better position than many other countries to find alternative markets to the US. There is almost a 50% overlap between what China sold to the US and what it exports to BRICS nations, suggesting much of what America no longer buys can be shipped to other markets.

While Chinese exporters are defying the odds, surging trade isn’t making them richer — or helping the nation’s domestic issues. Profits at industrial firms fell 1.7% in the first seven months, as manufacturers trying to reduce overcapacity at home under Xi’s “anti-involution” drive slashed prices to sell more overseas.

Summary: The above Chinese export shock to RoW specially EU, India & ASEAN implies deflationary forces at play for these economies as cheap Chinese exports replace domestic output. As a result, Chinese policy makers are also allowing CNH to appreciate as a goodwill gesture to these dumping grounds. We see CNH appreciating to 6.5 levels by mid CY26. But medium term these region’s domestic manufacturers will get affected adversely needing anti-dumping provisions as well as fiscal & monetary support. What Trump has created is a deflationary shock for the RoW.