The sharp move higher in US assets tonight after President Donald Trump cited a “framework of a future deal” on Greenland signals the sharp market reversals that were a hallmark of the first year of Trump’s second term are alive and well -- even as investors had started to doubt it. A fast change of stance after just a small pullback in risk assets this week will reinforce belief in these types of trades, based on the market perception that Trump tends to back down from previous positions, will keep policy-related equity selloffs even shallower as a result.

Developments on Greenland have taken equities back to their default setting: a market that wants to melt higher as optimism over a re-acceleration in growth broadens.

That de-escalation sparked a sharp squeeze higher in US equities, as 0DTE positions were forced to unwind. It was as close to a worst-case scenario for traders who already sat through an outsized up move and an equally violent down move on the day, then got hit by a late-day headline after two hours of calm. When the news finally leaned risk-on, the unwinding process did the rest.

Under the hood, the Russell 2000’s outperformance confirms the narrative of growth acceleration, with small-cap value beating small-cap growth. More broadly, breadth was strong, defensives lagged, and stocks in Goldman Sachs’s most-shorted basket outperformed, which fits the idea that this rally can continue without the participation of the mega caps.

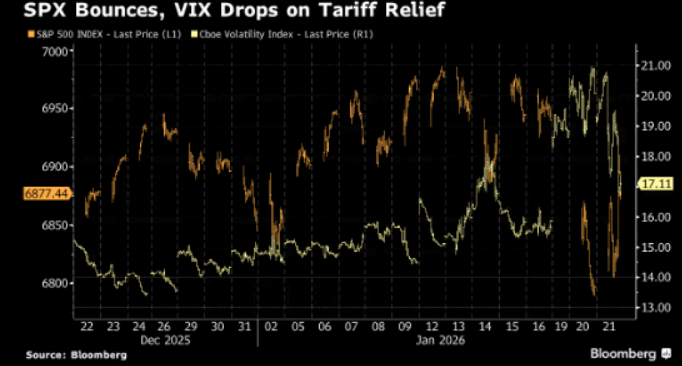

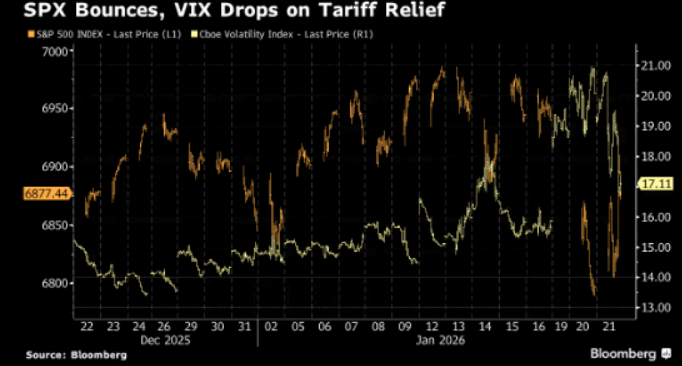

The S&P 500 Index is back near where dealer hedging flows will weigh on realized vol. Even after last Friday’s option expiration, the 6,900-7000 area still has strong gravity with enough positive gamma holdings to cap intraday swings.

Volatility declines with the VIX Index back to around 17 and the VVIX back toward 100 show the fear premium that was built up on Tuesday has receded quickly. Implied correlations have eased too, which is the market’s way of returning focus to micro catalysts as earnings season ramps up and single-stock volatility stays sticky.

That does not mean path higher is a forgone conclusion. Geopolitics is rotating, not disappearing, as Iran risks linger. Next week’s FOMC meeting also retains a volatility premium in markets, while the buyback blackout period reduces the mechanical bid for equities that has supported much of the recent melt-up.

But the easing of the Greenland headline risk for now will leave the market in a much more receptive mood going into a big week for earnings. We have Tesla, Meta and Microsoft to look forward to after the closing bell next Wednesday and Apple next Thursday. Tesla doesn’t really trade on earnings, but Microsoft has been under pressure recently, amid growing market scepticism around AI.

Our S&P 500 target is 7015 as per our trade reco on 8th Nov (when S&P was at 6729) & we still hold on to that view:

https://macro-spectrum.com/trade-recommendation/buy-sp-500