Crypto’s reputation as a “fast money” play is being put to the test as risk appetite drains from global markets. Digital assets are coming under renewed strain, mirroring the pressure in equities as funding conditions tighten and investors retreat to traditional havens.

Bitcoin, often viewed as a proxy for highly speculative risk-taking, is sliding in tandem with stocks amid a classic risk-off move: Equities are soft and Treasuries are bid as the VIX briefly traded with a 25 handle. The move underscores crypto’s evolution from an isolated niche to an extension of broader market sentiment a “levered beta” trade for those seeking volatility and thrill.

Unlike traditional assets, however, crypto’s beta makes it particularly vulnerable when liquidity evaporates. The space thrives on easy money and high leverage characteristics that leave it exposed when funding costs rise and overnight markets tighten. Stress in the repo and short-term funding complex, highlighted by the recent jump in secured overnight rates, adds to the unease.

In an environment where even traditional funding markets are flashing caution, digital assets are finding little room to run. This isn’t a setup for a melt-up to fresh highs, but one where the cost of money not the appetite for risk is rising fast.

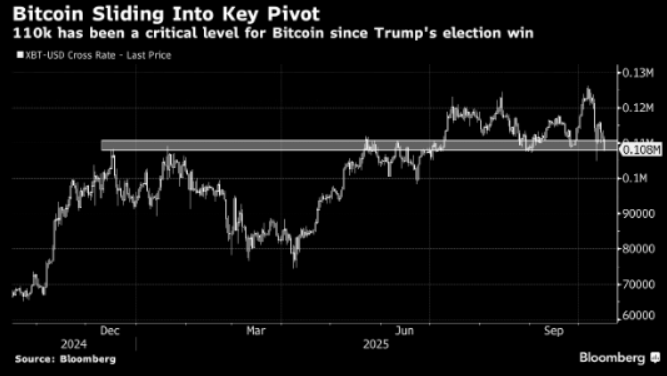

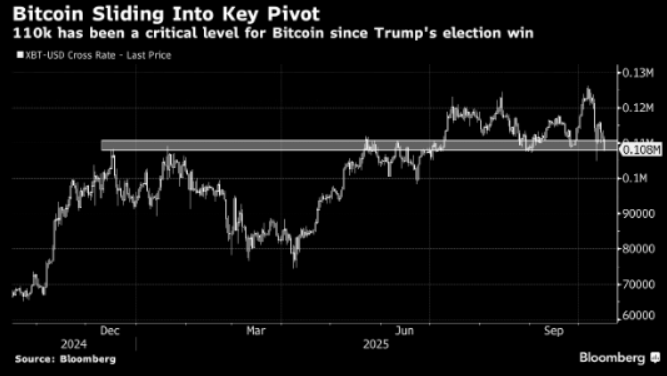

The $110,000 level has emerged as a key structural pivot for Bitcoin following the 2024 election. It’s also a critical risk-reward inflection point: Current levels of $108,000 implies swift downside action similar to what was seen last Friday, when prices fell from $117,000 to $105,000 in a matter of minutes. But we wait for a daily close confirmation below $110,000.

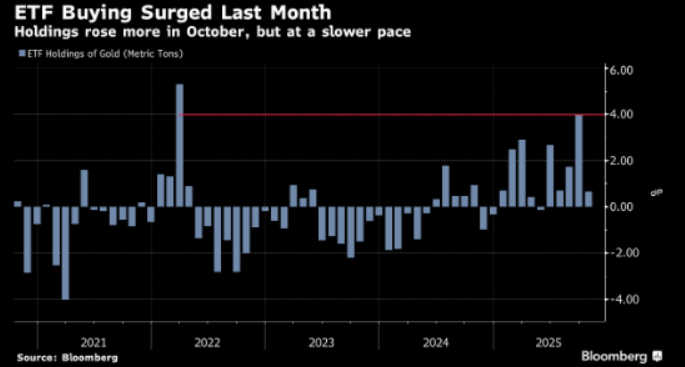

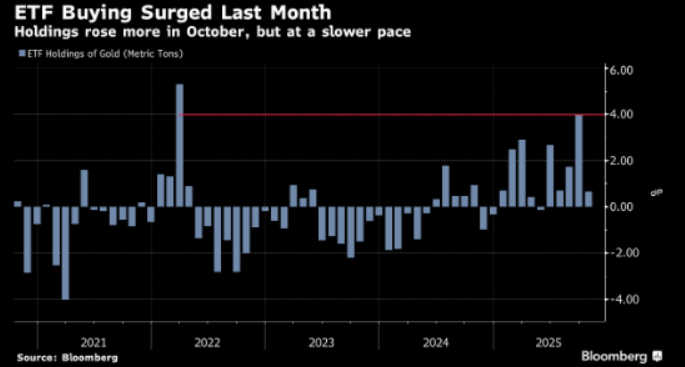

Gold currently at 4350 has more room to go higher if risk off gains steam due to US regional bank issues. Yes, there could be intermittent sharp corrections due to overbought technical but these dips might be bought into rather than left to fall. The megatrend of Gold at one point of time will strike against the megatrend of AI valuations. Then one of the two might see the eventual melt down but we are still far away from that moment of truth. Continued US shutdown, global fiscal debts & above all the latest bull on Gold is US retail crowd as seen by ETF flows. Holdings in physically-backed gold ETFs tracked by Bloomberg have jumped nearly 6% over the past seven weeks, the most since April 2022. Based on the most recently available data, ETFs appear to be adding bullion at a much faster pace than central banks in recent months.

Gold ETFs have gobbled as much gold in September alone (115 metric tons) as central banks did during the first two quarters of this year combined, according to data compiled by the World Gold Council. The WGC will have a update on the third-quarter changes at the end of the month. In August, central banks likely added a net 19 tons to global reserves in August, data show, while ETFs added 48.6 tons.

Summary: Gold might fare better than Bitcoin in the spectrum of non-interest bearing speculative assets.