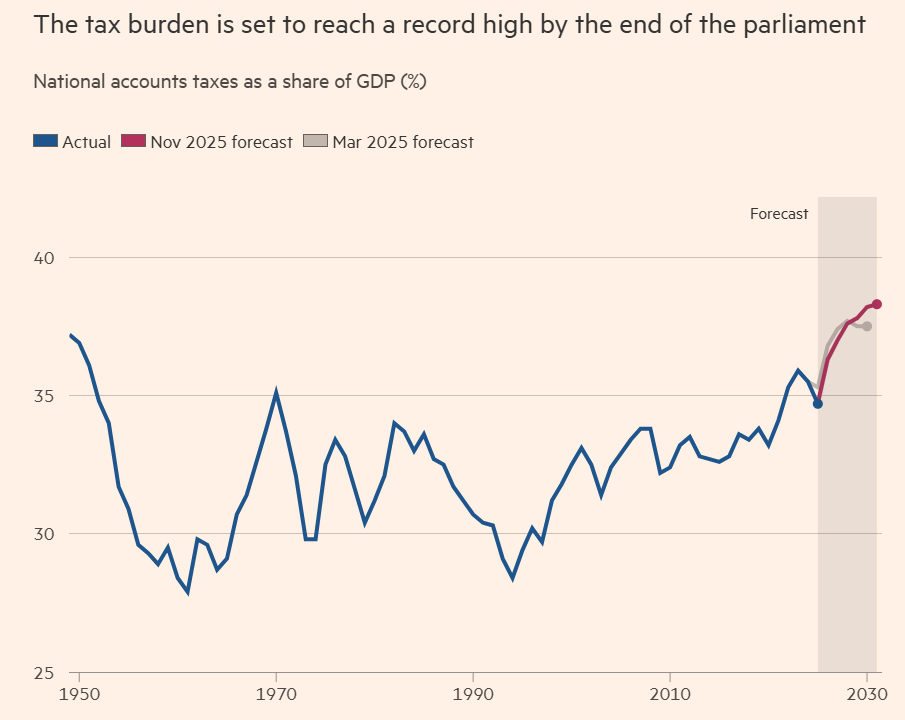

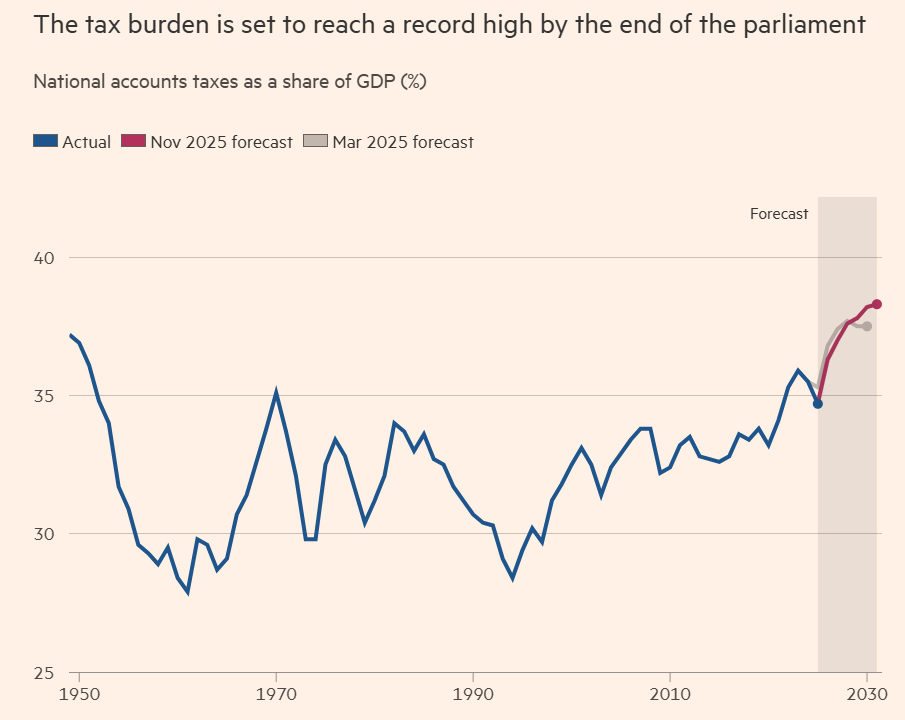

Chancellor Rachel Reeves delivered a Budget that takes UK taxes to an all-time high, hitting workers, the wealthy and business to fund higher welfare spending and build up her emergency buffer. Reeves, who increased taxes by £40bn in her first Budget last year, announced a further £26bn hike today that will lift the overall burden to 38 per cent of GDP by the end of the parliament. The overall tax take is projected to rise to an all-time high of 38.3% of economic output.

The pound strengthened above $1.32 and bonds climbed, pushing the 10-year yield lower for a fifth day to 4.42%. The 30-year yield dropped 11 basis points, headed for the biggest daily slide since April, after the Debt Management Office announced it would sell less long-dated debt.

The narrative that has emerged is that the barrage of tax hikes and spending promises has allowed Reeves to increase a key cash buffer. That leaves the government less vulnerable to moves in the bond market, reducing the need for it to come back with another tax-raising plan next year.

The key focus among traders was the UK government’s fiscal headroom essentially a measure of the bandwidth that Reeves has before she’s at risk of breaking the government’s self-imposed rules.

Prime Minister Keir Starmer’s government has imposed two fiscal rules in a push to win over bond investors. The first and most important is what Reeves calls the “stability” rule: that day-to-day government spending should be covered by tax revenues in the 2029-2030 financial year.

As well as revealing a buffer of a larger-than-expected £22 billion, the OBR also downgraded its growth projections to reflect lower productivity assumptions, while forecasting higher inflation and stronger wage growth.

The principle involved is that borrowing is only for investment. While she only left a £9.9 billion buffer, effectively a spare amount of cash she can draw down without breaking the rule in March, that is now being increased to £22 well in excess of the median estimate of £15 billion from the banks surveyed by Bloomberg.

The backloaded nature of the fiscal tightening does raise questions over how credible Reeves’ plan is. The government is trying to balance the demands of bondholders for fiscal prudence against the political reality that its lawmakers have already rebelled this year against cost-cutting measures.

The Office for Budget Responsibility has slashed its forecast for real GDP growth in 2026 by 0.5 percentage point to 1.4%, which marks a major downward revision. It has concurrently raised its estimates of inflation over the next two years by about 0.5 percentage point.

The OBR was generous to Reeves. A much-anticipated productivity downgrade was expected to cripple the public finances and leave her scrambling for as much as £30 billion to restore the £9.9 billion buffer against her main fiscal rule that taxes must cover borrowing in 2029-30, forcing painful decisions. The fiscal damage from their revision was far less than expected at £6 billion. That’s because faster wage growth and higher inflation lifted tax receipts and offset much of the impact of weaker activity.

The UK plans to sell £303.7 billion of gilts in the fiscal year 2025-26, the Debt Management Office said today. That compares with a survey estimate of £308.1 billion.

We have had similar expectations from UK budget as per our opinion piece on 22nd Nov:

https://macro-spectrum.com/opinion/uk-autmn-budget-preview

For the same reasons, we were also bullish on UK rates as per our trade recommendation on 16th Nov & it has played out well with 10yr UK gilts currently lower by 16bps from our recommended buy levels:

https://macro-spectrum.com/trade-recommendation/buy-10yr-uk-gilts