We have written recently in our premium opinion piece on 18th Oct about a jobless US GDP growth as below:

https://macro-spectrum.com/opinion/us-is-having-a-jobless-gdp-growth

Yesterday we saw reports that Amazon is planning to cut as many as 30,000 corporate jobs which is likely to further intensify concerns about the US jobs market. The planned reduction would represent nearly 10% of the company’s roughly 350,000 corporate employees. Cuts come as the company works to pare expenses and compensate for over hiring during the peak pandemic demand.

But Amazon is not along in these job cuts. American employers are increasingly making the calculation that they can keep the size of their teams flat or shrink them through layoffs without harming their businesses. Part of that thinking is the belief that artificial intelligence will be used to pick up some of the slack and automate more processes. Companies are also hesitant to make any moves in an economy that many still describe as uncertain.

JPMorgan Chase’s chief financial officer told investors recently that the bank now has a “very strong bias against having the reflective response” to hire more people for any given need. Aerospace and defense company RTX boasted last week that its sales rose even without adding employees.

Goldman Sachs, meanwhile, sent a memo to staffers this month saying the firm “will constrain head count growth through the end of the year” and reduce roles that could be more efficient with AI. Walmart, the nation’s largest private employer, also said it plans to keep its head count roughly flat over the next three years, even as its sales grow.

“If people are getting more productive, you don’t need to hire more people,” Brian Chesky, Airbnb’s chief executive, said in an interview. “I see a lot of companies pre-emptively holding the line, forecasting and hoping that they can have smaller workforces.”

Airbnb employs around 7,000 people, and Chesky says he doesn’t expect that number to grow much over the next year. With the help of AI, he said, he hopes that “the team we already have can get considerably more work done.”

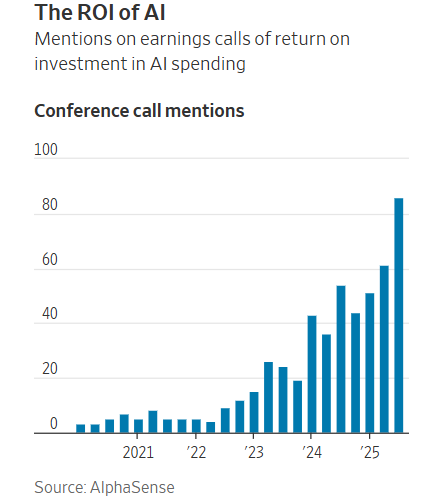

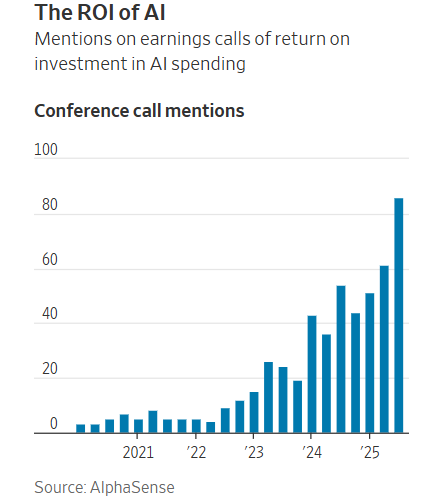

The desire to avoid hiring or filling jobs reflects a growing push among executives to see a return on their AI spending. On earnings calls, mentions of ROI and AI investments are increasing, according to an analysis by AlphaSense, reflecting heightened interest from analysts and investors that companies make good on the millions they are pouring into AI.

The downtick in the Bloomberg Dollar Spot Index & US bond yields though speaks to investors’ skittishness about a worsening labor market. And that is where we believe Fed might find difficult to stimulate employment. We will be soon releasing a detailed premium opinion piece on this.