This week’s economic calendar should feature a healthy dose of data amidst a sprinkling of Fed speak.

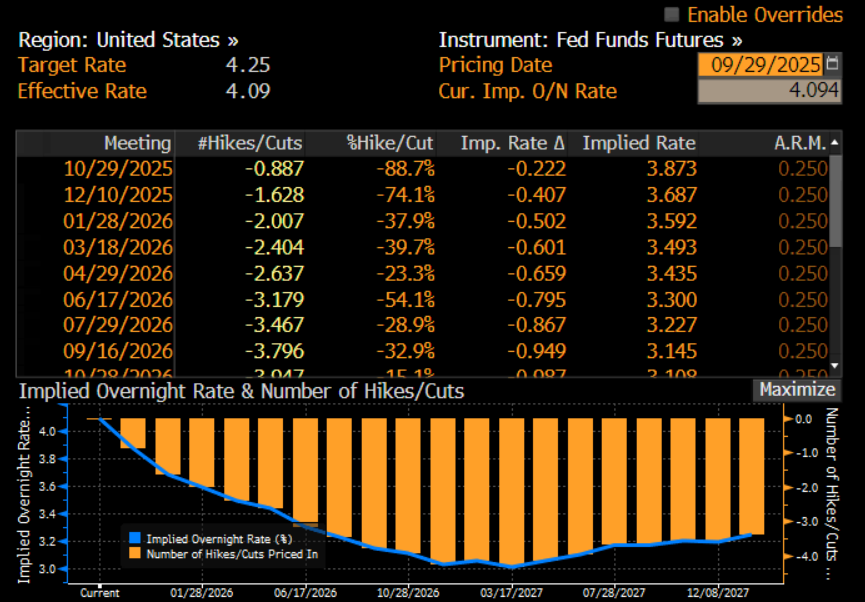

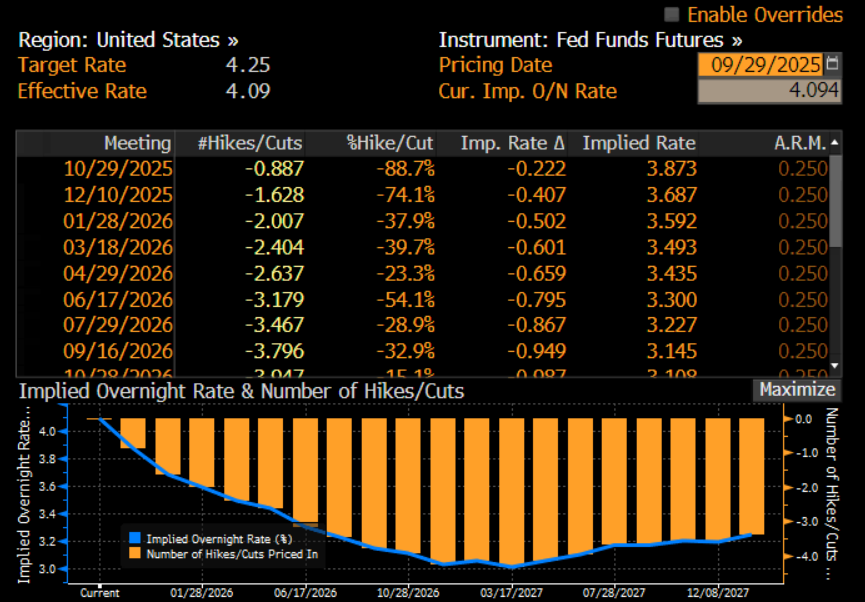

US payrolls, a speech by UK’s Reeves, and China PMIs are among the main catalysts for markets this coming week. Friday’s jobs report will shape the Fed’s rate path & give more clarity on the remaining cuts being priced for REMCY25. Currently markets are pricing in 41 bps of cuts for REMCY25. Terminal rates are currently being priced at 3.10 from the lows of 2.85 post pre-17th Sep FOMC.

In Asia, China’s PMI run and Golden Week consumption are in focus, alongside the RBA decision and Japan’s Tankan survey. In the UK, Chancellor Reeves’ Labour Party conference speech, plus GDP and PMI data, are in focus after last week’s run of weak demand at bond auctions. German and euro-area CPI are also due.

However, with the risk of a US federal government shutdown high, there is a significant chance that this week’s main event, Friday’s September employment report, could be delayed.

Federal government statistical releases will likely be delayed in the event that Congress is unable to reach agreement on a short-term funding resolution by midnight September 30.

Data releases from the BLS, BEA, and Census Bureau would be postponed for the duration of a shutdown. This would include the September employment report (scheduled for 3 October) and CPI (15 October), as well as retail sales and PPI. We would continue to receive labor market updates from the weekly jobless claims data, the ADP employment report, and surveys from ISM, PMI, and regional Federal Reserve banks.

Debt market capital raises this week are likely to slow as trading desks attempt to stay nimble amid worries about a US government shutdown, which could take effect Wednesday if Congress doesn’t manage to avert it.

Dealers expect about $25 billion in US high-grade issuance this week, compared with $56 billion sold last week.

September already ranks as the month with largest volume of issuance in 2025. Just $3 billion more sales would put September at $200 billion -- a monthly threshold crossed only four times previously, including three times in 2020.

The CFTC Commitments of Traders report has been released, showing futures positions as of Tuesday’s close. Highlights of speculative positioning include:

In fixed income, flow was mixed but skewed towards buying. Speculators purchased a net 103k 2s, 8k ultra 10s, 15k long bonds, and 7k ultras while selling 17k 5s and 25k 10s. The aggregate duration short fell by 93k TY equivalents. In STIR markets, traders bought 89k SOFR futures.

In FX, punters sold 3.4k euros, 7.6k CAD, 8.4k AUD, and 3.1k NZD. There was buying of 18.1k yen, 4.6k sterling, 3k CHF, and 5.4k MXN, and the aggregate dollar short rose by around $750 million on the week.

In equities, the net S&P short fell by 53k, the NDX long increased by 6k, the Dow saw buying of 9k, and the Russell saw net buying of 34k, the largest since 2018. This may actually have just been a function of the triple-witching expiry, as the gross amount of longs and (especially) shorts both declined on the week. The VIX position was little changed.

Elsewhere, the oil long increased by 4k but gold and copper positions were little changed.

The week ahead calendar looks as below:

Monday, Sept. 29

APAC

EMEA

Euro-area consumer confidence

Spain CPI

UK mortgage approvals

ECB’s Lane Schnabel, Nagel, Muller, Cipollone, Centeno and Vujcic

UK’s Reeves speaks at Labour Party conference

Americas

Tuesday, Sept. 30

APAC

China manufacturing PMI, non-manufacturing PMI, RatingDog manufacturing PMI and RatingDog service PMI

Japan industrial production, retail sales and housing starts

Australia building approvals and private sector credit

RBA interest rate decision

BOJ summary of opinions

RBA’s Bullock

EMEA

German CPI and unemployment rate

France CPI

Italy CPI

UK GDP and current account balance

ECB’s Lagarde, Nagel, Rehn and Cipollone

BOE’s Lombardelli, Mann and Breeden

Americas

US JOLTS job openings, consumer confidence, house price index and Chicago PMI

Fed’s Jefferson and Goolsbee

Chile copper production

Wednesday, Oct. 1

APAC

EMEA

Euro-area CPI P and manufacturing PMI

ECB’s Guindos, Kazimir, Kocher and Simkus

UK Nationwide house price index and manufacturing PMI

BOE’s Mann

Americas

Thursday, Oct. 2

APAC

EMEA

Euro-area unemployment rate

Swiss CPI

ECB’s Villeroy and Guindos

BOE decision maker panel survey

Americas

Friday, Oct. 3

APAC

Japan jobless rate

BOJ’s Ueda

EMEA

Euro-area PPI and service PMI

France industrial production

UK service PMI

ECB’s Lagarde, Sleijpen, Villeroy and Schnabel

BOE’s Bailey

Americas

US nonfarm payrolls, unemployment rate, average hourly earnings, service PMI and ISM services

Fed’s Williams and Jefferson