As per White House comments today, the October jobs and consumer price index reports are unlikely to be released due to the government shutdown. The Bureau of Labor Statistics and other key statistical agencies had stopped producing and publishing economic data during the government shutdown.

The BLS, which is in charge of making decisions regarding the scheduling of its reports, has not released an updated schedule for which indicators will be released and when. It’s possible the agency will choose to combine two months’ worth of data for a particular statistic into a singular release to get back on track.

This implies traders and policymakers are without two of the most important guideposts for monetary policy. The result is a market that’s no longer data-dependent, but still data-deprived.

The longer the data blackout persists, the greater the appeal of defensive duration and tangible stores of value. Treasuries rallied hard across the curve on Wednesday as investors sought refuge from the information vacuum. Metals surged in tandem: gold rose another 1.7%, while silver extended its stealth rebound, now up more than 17% from its October low. The message is clear: when investors can’t model the data, they buy the assets that hedge their absence.

Even if the data were to be released, the initial set of data might be weak leading to safe haven demand in US treasuries & precious metals. Softer labor readings and weaker growth would reinforce expectations for more Federal Reserve interest-rate cuts, putting renewed pressure on the dollar and supporting bullion.

The dollar’s near-7% decline this year accounts for roughly 10 percentage points, about one-sixth, of gold’s 57% gain, with the rest driven by falling real yields, steady central-bank demand and safe-haven flows.

After gold’s surge past $4,300 an ounce in summer, its strongest rally in decades, prices briefly turned volatile as profit-taking hit and some investors rotated into risk assets. Exchange-traded funds have now seen three straight weeks of outflows, but physical demand and central-bank buying helped prices stabilize around $4,100 heading into the final quarter.

With the US government looking likely to reopen, a backlog of data could boost that momentum. Early reports already point to a softer jobs market, adding to other signs of slowdown, for example the copper-gold ratio. That would likely weigh on the dollar and give gold another push higher.

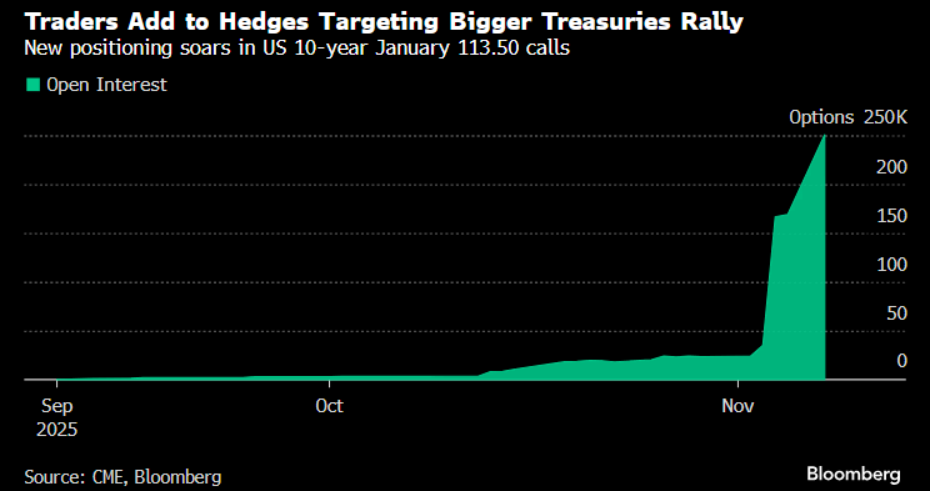

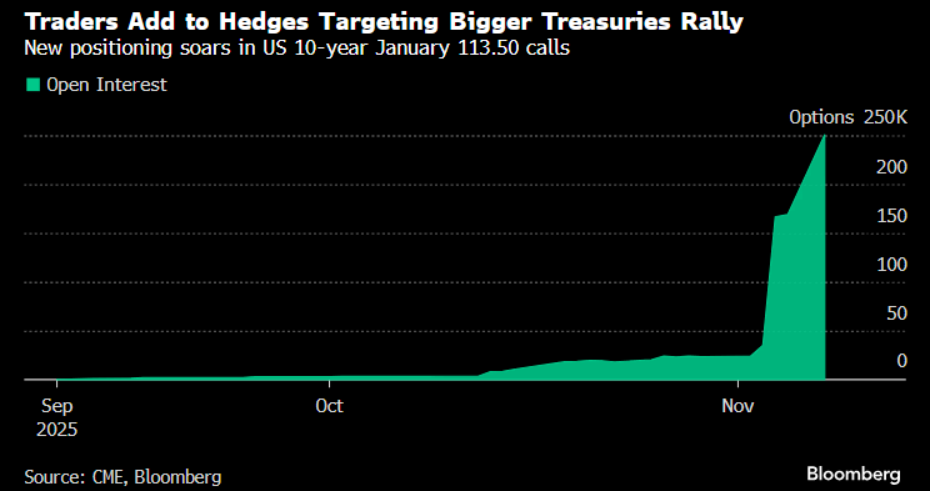

Bond traders are also piling into Treasury options targeting a drop in the 10-year yield below 4% in coming weeks, betting a cascade of data will show the US economy is weakening. One position, bought for a combined premium of $45 million, is targeting the 10-year yield to drop to as low as 3.9%.

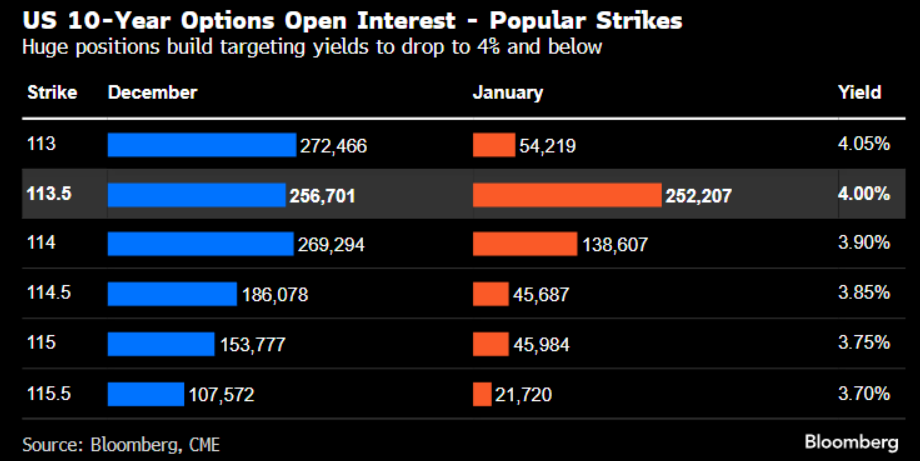

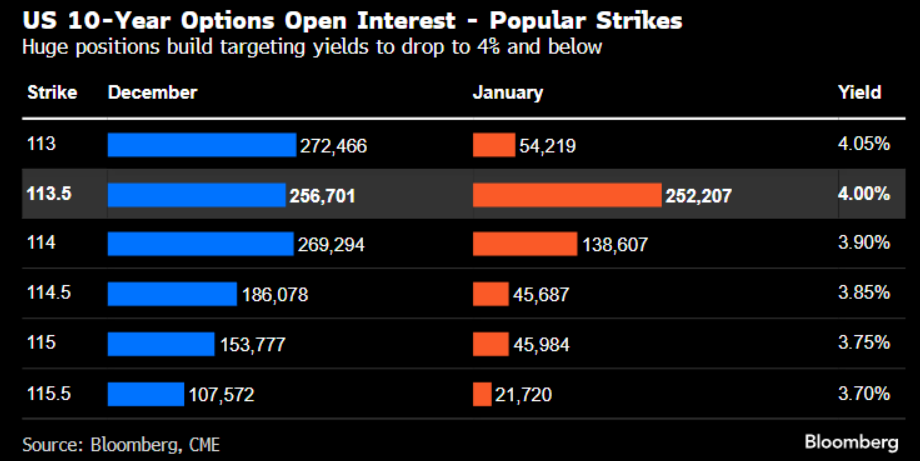

Open interest, or the amount of new positions held by traders, has rapidly risen in bullish options over the past week, targeting a bigger Treasuries rally. The trades have been focused in both the December and January options, which expire Nov. 21 and Dec. 26.

Most of the buying has occurred in strikes which equate to a 4% yield on 10-year Treasuries, and the options start to make money in a bigger rally taking yields below that level.

Open interest in the 113.50 strike has risen by over 600% in the past week. Monday’s flows cost a premium of roughly $40 million, on top of around $70 million spent last week on the same trade, which stands to profit on US 10-year yields dropping below 4%.

To summarise, in both situations, whether the Oct data gets lost for ever or data starts getting released with first batch being exceptionally weak due to shutdown, safe haven demand might keep precious metals strong & long end USTs bid. Unless the US Supreme Court comes to spoil the party by announcing all IEEPA tariffs illegal.